Introduction: Latecomer, but front-runner

Introduction: Latecomer, but front-runner

The industrial production of alternative protein, using the innovative technology of fermentation to make plant-based meat, cell-cultured meat, and protein, is one of the fastest-growing sectors in agriculture. With the possibility of making novel proteins in a more sustainable approach, this sector is creating huge opportunities for innovators, entrepreneurs, and investors. We have also found dynamic development within the sector, with the most robust activities found in the field of fermentation-derived protein for the years 2020 and 2021.

Plant-based meat is the first innovative alternative protein that entered the market. Beyond Meat brought its “Chicken-Free Strips” to market in 2012. The company made an IPO in 2019 and became one of the more successful IPOs on the US market.1 However, not everyone is convinced that the entirety of humanity can be turned into vegetarians. That’s why another innovation in alternative protein – cultured meat – made sense. The nascent cultured meat industry produces real animal meat in bioreactors, which is seen as a more sustainable alternative to the animal protein produced by traditional livestock. Despite major challenges in production cost and regulatory approval, in 2020, the company Eat Just managed to debut a hybrid chicken nugget made from plant-based protein and cultured meat in Singapore.2

The year marked the breakthrough of another alternative protein technology – fermentation. Perfect Day received approval from the US Food and Drug Administration (FDA) for the world’s first milk protein produced through precision fermentation, launched the world’s first ice cream made from cow-free milk, and raised US$300 million from investors, all in one year. Although a latecomer in the field of alternative protein, fermentation has become the frontrunner and has seen the highest investment increase within the field of alternative protein in 2021. Fermentation was described by the Good Food Institute, a leading non-profit organization promoting alternative protein, as an “enabling technology for the alternative protein industry”.3

In this document, the term “fermentation” will be used to refer to three different applications in the context of food:

- Traditional fermentation uses microorganisms to improve food flavor, nutrition, and texture.

- Biomass fermentation grows a large number of microorganisms efficiently to produce protein.

- Precision fermentation uses genetically engineered microorganisms to produce specific molecules, such as milk protein.

Why has the fermentation business grown at such an impressive speed, and what future potential does it hold?

Market opportunities

Market opportunities

Fermentation can produce large quantities of proteins from microorganisms. It can also use genetically reprogramed microorganisms as “cell factories” to produce proteins and other valuable molecules. The method is efficient, consumes fewer resources than conventional animal husbandry, and has the flexibility to synthesize specific molecules in a targeted manner. There are robust opportunities in both Business-to-Business (B2B) and Business-to-Consumer (B2C) markets.

B2B market opportunities

Theoretically, precision fermentation can produce any valuable molecule through “cell factories” in a more efficient and environmentally friendly manner than traditional methods. There are great opportunities for precision fermentation startups to form partnerships with conventional food companies as ingredient suppliers, and with other alternative protein startups as suppliers of key components.

Fermented products as ingredients for traditional food products

Milk protein is the most active sector in precision fermentation. In 2020, Perfect Day, a California-based precision fermentation startup, developed the world’s first animal-free milk protein. The company initially supplied its milk protein only through B2B channels before deciding to develop its own end products. Egg white protein is the second alternative protein that is currently available through precision fermentation. The company Every, previously known as Clara Foods, announced in November 2021 that it would launch its animal-free egg white protein through a B2B partnership.

The global dairy protein market, valued at US$9.9 billion in 2019, is expected to grow at a rate of 4.6 percent from 2021 to 2027.4 New consumer trends, including the increasing demand for more sustainable and ethical products, give alternative protein produced through precision fermentation a competitive edge.

Fermented products as ingredients for other alternative protein companies

Growth factors are a group of proteins that are essential for growing cell cultures. They are also the main reason for the high price of cell-cultured meat, accounting for an estimated 55 – 95 percent of the production costs in the cultured meat industry.5 Precision fermentation provided an efficient method for producing growth factors by targeting these valuable molecules and expressing them in microorganisms through genetic reprogramming.

Proteins, fats, and other molecules can also be used as ingredients to improve the nutritional value and taste of plant-based protein products. Rather than being a stand-alone category, precision fermentation is increasingly viewed as a technology that will enhance the function, value, and efficiency of alternative proteins across the entire sector.

Fermented products as ingredients for pet food

Pet food is another promising market opportunity for fermentation. The value of the pet food market reached around US$100 billion in 2020, and the industry is putting increased emphasis on protein-rich diets.6 Animal protein used in pet food accounts for 25 to 30 percent of the environmental impact from animal products.7 Using precision fermentation products in pet food can help reduce its environmental impact. Producers of food for human consumption will also be able to make use of technology developed in pet food applications.

B2C market opportunities

In 2020, Perfect Day achieved another world’s first by bringing to market an ice cream made with precision fermented milk protein. The company began marketing its second consumer product, cream cheese made from cow-free milk protein, in 2021.

Other potential direct-to-consumer opportunities include egg white protein and protein products made directly from microorganisms. US startup Every has already received FDA approval for its egg white protein. Finland-based Solar Foods is applying for permission to promote its biomass protein as a “novel food” in Europe. It is possible that the two companies will follow Perfect Day’s example by launching their products on both the B2B and the B2C markets.

Technology and development

Technology and development

The bioprocess of fermentation

Fermentation is an ancient technology that uses microorganisms like yeast and bacteria to break down food components. Fermented food has a unique taste and can last longer. Examples of fermented food include yogurt, wine, beer, pickled tofu, and sauerkraut. In precision fermentation, modern biotechnology has made it possible to genetically engineer microorganisms to produce desired molecules such as milk protein. In this way, microorganisms such as yeast and bacteria become efficient “cell factories” that can be controlled precisely to produce proteins, enzymes, vitamins, fats, etc.

The fermentation process has two parts – upstream and downstream. The upstream activity involves selecting microorganisms, media preparation, and cultivation of cells until they are ready to be harvested. The downstream process involves extraction and purification of the product.8

(Video credit: Perfect Day)

Key research areas

Although the technical challenges of fermentation are less daunting than those in the production of cell-based cultured meat, the field still faces key development challenges, namely in connection with cost reduction and scaling up. Some of the main solutions to address these challenges include selecting or engineering more efficient strains, using more sustainable feedstock, optimizing the design of bioreactors, and increasing harvest capacity.9

Start-up ecosystem in fermentation for alternative protein

Start-up ecosystem in fermentation for alternative protein

The 60 fermentation startups listed at the end of this update are companies using one of the three fermentation technologies (traditional fermentation, biomass, and precision fermentation) to produce food or food ingredients for humans or animals. The list does not include fermentation startups that produce ingredients for pharmaceuticals, cosmetics, energy sources, and other applications, which are also very active areas. The list has been compiled from the database of business intelligence provider Crunchbase, with reference to the 2020 State of the Industry Report Fermentation produced by Good Food Institute.

The new start-ups

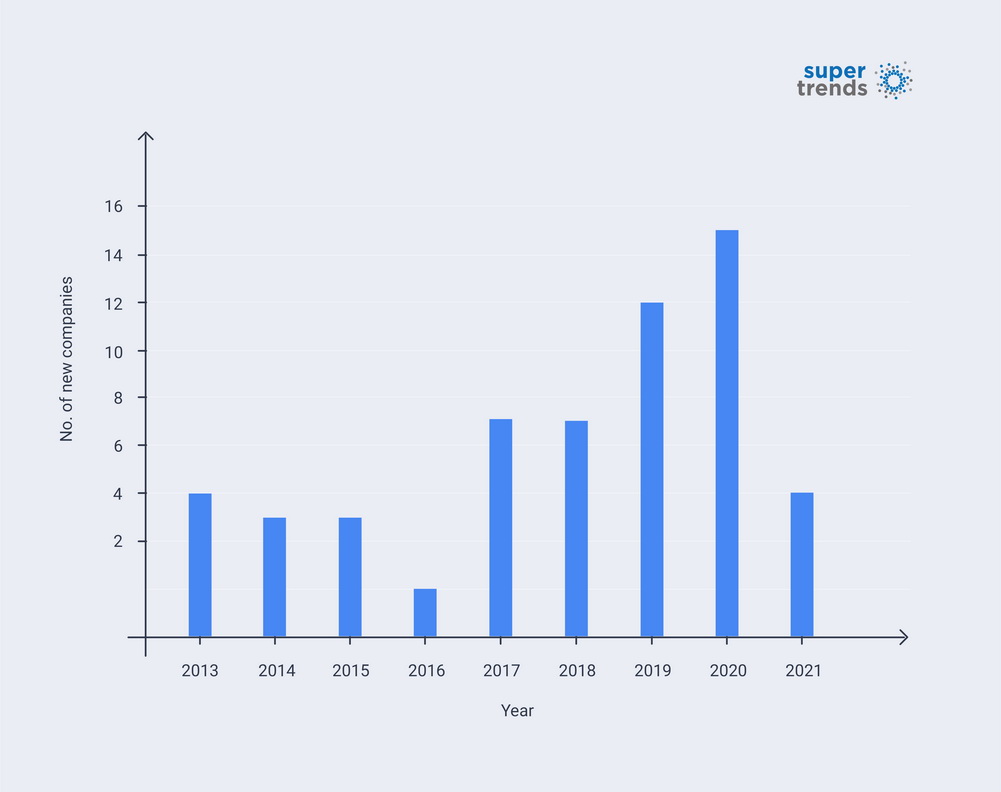

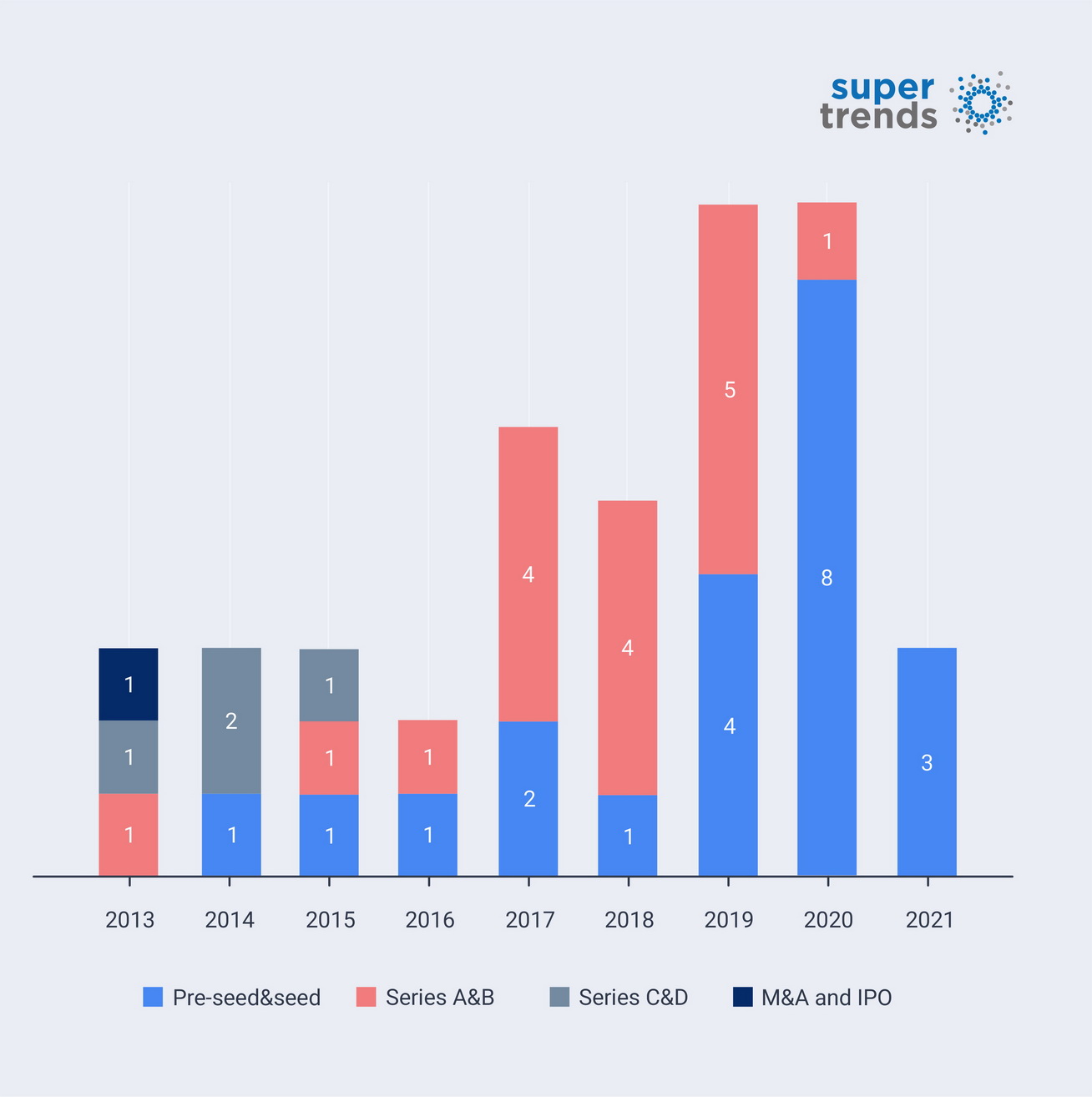

Almost all the start-ups in our list were founded after 2013, which could be considered the year that fermentation took off as a method of producing alternative protein. 2019 marked another breakthrough year in this field, as the number of new companies exceeded ten for the first time. This increase in number may have been driven by the first approval from the US Food and Drug Administration (FDA) for an animal protein made without animals – the milk protein produced by the company Perfect Day. Fermentation, especially precision fermentation, received a lot of media coverage in 2019 and 2020 due to both the FDA approval for fermented alternative protein and the successful commercial launch of Perfect Day’s animal-free ice cream. We expect to see the sector return to lower but steady growth going forward.

Start-ups with different types of products

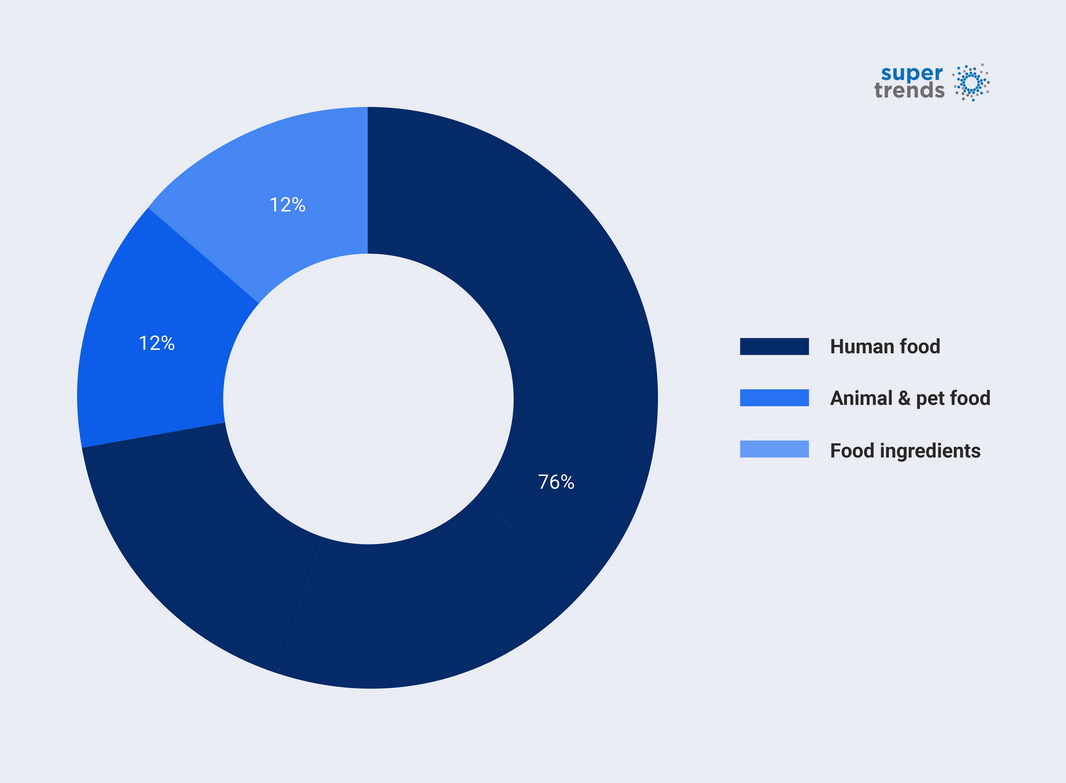

When the start-ups are categorized by type of product, we find that 46 out of 60 companies have set themselves the target of synthesizing human food. These fermented human foods include animal-free dairy products (made by 15 start-ups), meatless meat (11 start-ups), and new protein produced from microorganisms (13 start-ups).

Start-ups with different types of technology

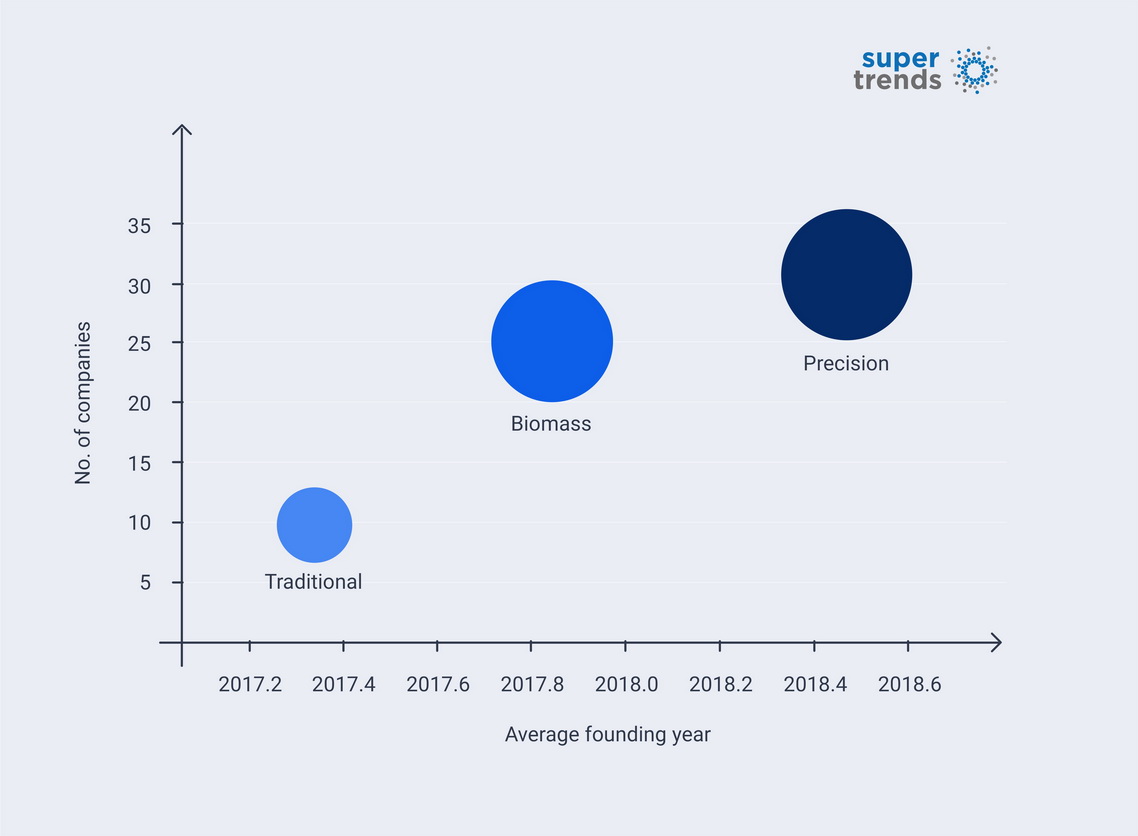

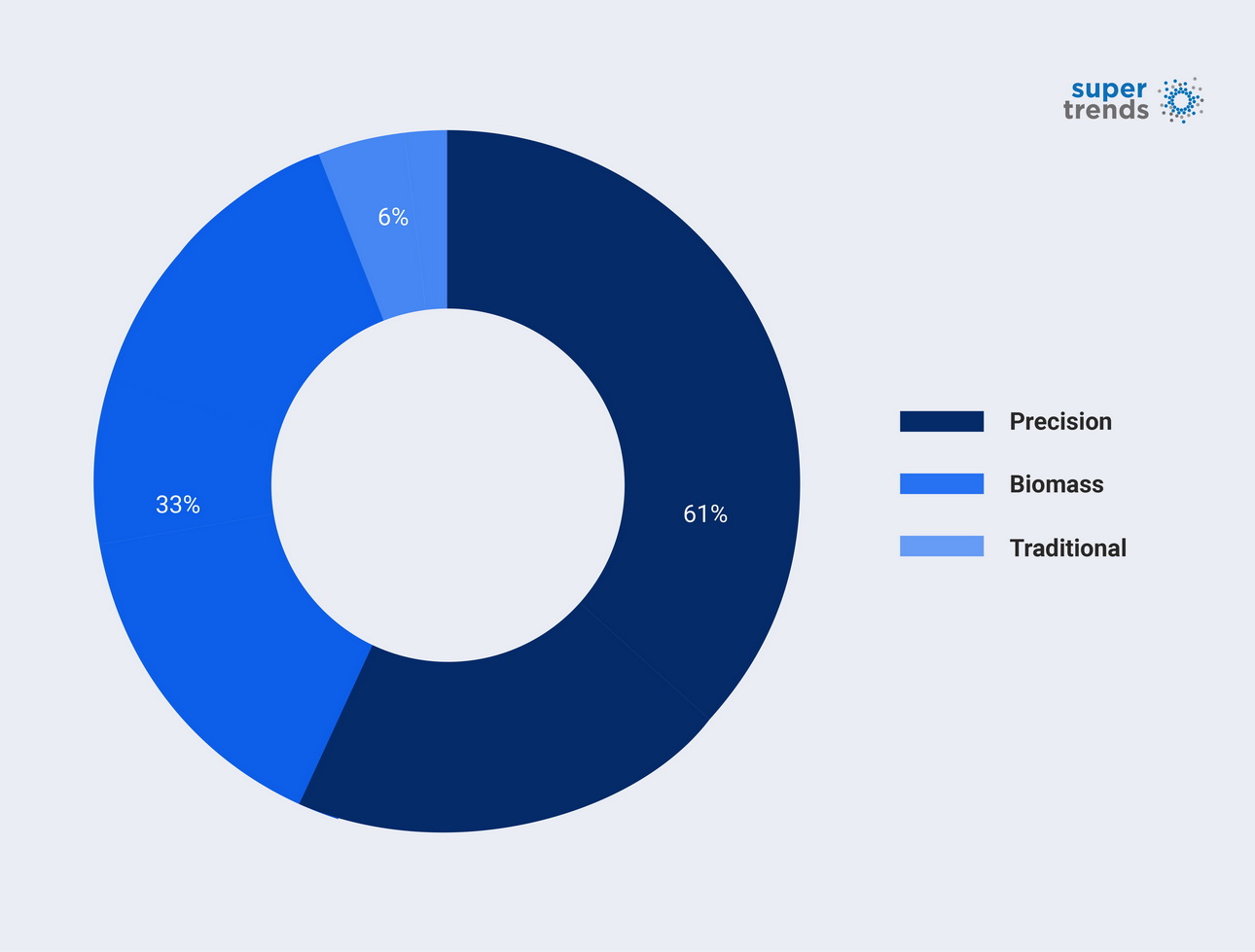

A closer look at the three fermentation technologies reveals that traditional fermentation is used by several start-ups to develop whole-cut meat; in biomass fermentation, the microorganisms themselves serve as highly efficient protein sources; precision fermentation uses genetically reprogrammed microorganisms as “cell factories” to produce high-value molecules. In our list of 60 fermentation companies, nine are focused on traditional fermentation, 23 are using biomass fermentation, and 28 are dedicated to precision fermentation.

We believe that biomass fermentation can provide highly efficient and sustainable animal feed. All five of the companies we have listed as targeting the animal feed market are developing their products through biomass fermentation. Precision fermentation combines gene editing with fermentation to provide a process and that can be better controlled and deliver more diversified products. We think precision fermentation presents a major future trend in fermentation. More and more start-ups are taking up precision fermentation as their technology niche.

Investment landscape

Investment landscape

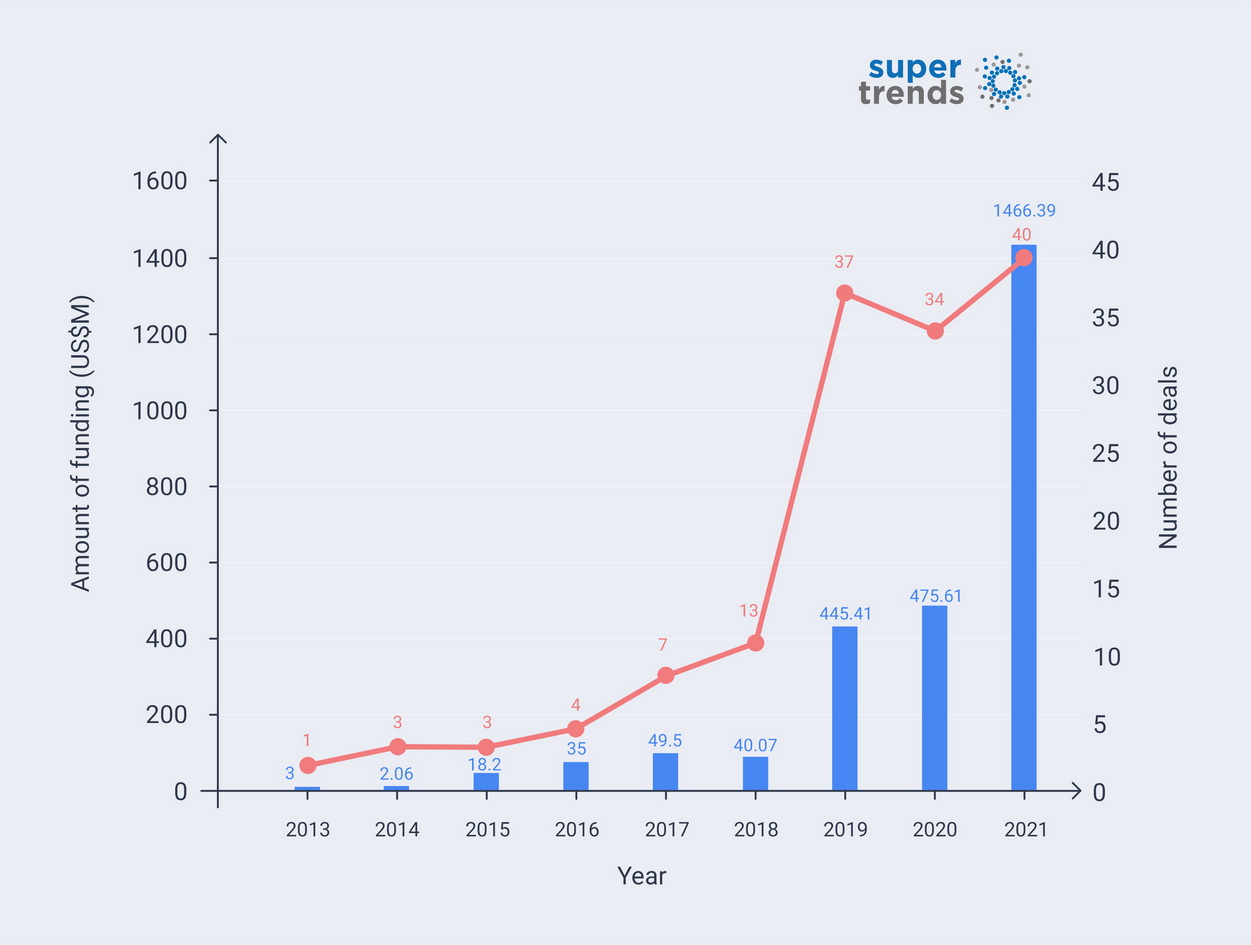

A snapshot of investment in the field of fermentation, based on our list of companies, shows that starting in 2019, investment in fermentation has experienced exponential growth, and the trend is continuing. Start-ups in this field mature at a relatively fast speed. Of the three technology categories, precision fermentation is the biggest winner in terms of investment money.

Funding growth

The year 2019 again proved to be a breakthrough year for investment in fermentation. The volume of funding increased more than tenfold compared to 2018, and more than 3.5 times as many deals were inked. In 2021, the amount of funding in fermentation reached more than US$1 billion. In 2021, investment in fermentation grew at a speed of 209% year-on-year compared to 2020. It became the fastest-growing sector in alternative protein.10 This overview of investments was based on the amounts disclosed on Crunchbase, which listed deals both with and without the funding amount being disclosed.

VC Funding stages

Start-ups in fermentation are maturing at a relatively fast speed. Based on data from Crunchbase, more than half of the start-ups that opt for venture capital (VC) funding will enter the early VC stage (Series A&B) in the third year after they are founded. And the majority will enter the late VC stage in year eight. NextFerm, founded in 2013, completed its initial public offering (IPO) on the Israeli market in 2021. Perfect Day, founded in 2014, is preparing for an IPO in 2022.11

Funding by technology

Of the three fermentation technologies, we believe that precision fermentation presents the future. Unsurprisingly, it also attracted larger amounts of investments. Precision fermentation, which is the technology of choice for 47 percent of all fermentation companies on our list, attracted 61 percent of the total investment from 2013 to 2021.

Government regulations and consumer opinions

Government regulations and consumer opinions

Products derived from precision fermentation are in general considered GMO-free, which could make for an easier path toward regulatory approval. Three alternative protein products produced through fermentation received “no questions” letters from the FDA. On the consumer front, animal protein derived from fermentation could potentially make plant-based meat more appealing to consumers by adding flavors and textures that are similar to those of animal-based products.

Government regulations

Approved in the US

In 1990, the US Food and Drug Administration (FDA) approved the first genetically engineered product for human consumption. The approval also marked the beginning of a B2B market for precision fermentation. The product involved is rennet, a milk clotting agent used for cheese making. For thousands of years, rennet had been made from a calf’s fourth stomach, which involves killing newborn cows. When the rising demand for cheese was poised to cause a supply shortfall, scientists found a way to produce rennet with genetically engineered microorganisms. This is the first time that precision fermentation revolutionized the cheese industry. Now, 90 percent of cheese in the US market is made with rennet produced through precision fermentation.12

At least three fermentation companies have received “no questions” letters from the FDA, meaning they can sell their products commercially.

- In March 2020, Perfect Day received a “no questions” letter from the FDA for its whey protein produced through precision fermentation.

- In June 2021, Nature’s Fynd, the biomass company backed by Bill Gates and Jeff Bezos, received a “no questions” letter from the FDA for its fungi protein.

- In September 2021, Every, previously called Clara Foods, received a “no questions” letter from the FDA for its egg white protein produced through precision fermentation.

The multiple approvals reflected the FDA’s positive view on fermentation-derived food ingredients.

Hurdles in Europe

Europe imposes more conservative food regulations, especially on genetically modified organisms (GMOs). While it is not common for traditional and biomass fermentation to use GMO technology, precision fermentation does involve genetically modified microorganisms. The EU GMO Regulation only covers food produced from a GMO, but not with a GMO.13 If the GMO material (the genetically modified bacteria) used in precision fermentation is removed after protein production, the final product – animal-free proteins – is considered GMO-free.

Another concern is labeling in the European market. The EU has banned the use of dairy-related terms, such as “almond milk”, and “vegan cheese”, for dairy-free products. While industry leaders in the fermentation sector are consolidating their position on the appropriate terms and labels that should be used on their products, Dr. Britta Winterberg, the co-founder, and CSO of German precision fermentation start-up Formo, told media that “[Europe] might not be the easiest market to enter, it’s very restrictive.”14

Elsewhere in the world

Singapore is the first country outside the US to approve Impossible Foods’ heme, the “blood” made from precision fermentation in its plant-based burger. The city-state, which aims to be 30 percent food self-sufficient by 2030, considers alternative protein to be one of the ways of achieving its food security goal. The food regulatory authority in Singapore has sent encouraging messages to alternative protein companies.

In February 2021, Impossible Foods received final approval from the food regulation authorities of Australia and New Zealand for its heme. The approval paved the way for Impossible Foods to launch its products in Australia and New Zealand.

Consumer opinions

Growing consumer awareness

Market analysts have found that there is growing consumer awareness regarding alternative protein. For reasons related to health issues, environmental concerns, and animal welfare, consumers’ interests are shifting, especially in wealthy countries.

Will the shift in consumer interest translate into consumer action? Currently, plant-based protein makes up most of the alternative protein products. Not everyone is convinced that plant-based products can fulfill consumers’ expectations, especially in terms of taste and texture. Fermentation-derived proteins might be able to fill this gap.

Filling the gap between plant-based and animal-based protein

Supertrends conducted an opinion survey investigating cultural influences on perceptions of meat in 2020. The study was done among university students in four different countries across Asia, Europe, and South America. It found that the taste, texture, and nutritional value of meat were the main factors determining whether respondents regarded meat as “edible”.15

It may be hard for consumers to replace chewy animal meat or creamy cheese with rigid and crunchy plant-based protein. On the other hand, protein derived from precision fermentation is identical to animal protein. That’s why Perfect Day claims its fermented milk protein has the same taste, texture, and nutrition as traditional dairy products.

Another recent study provides evidence that consumers prefer hybrid products over purely plant-based products. The study, conducted among cheese-loving French, found that cheese including both animal and plant proteins could be acceptable to half of the French population. The participants’ acceptance was largely based on the taste of products, with the nutritional benefit and, to a lesser degree, the environmental benefit also having a positive impact.16 Although the animal protein used in this study is derived from real animal products, it is not hard to imagine that dairy protein made from precision fermentation could perform the same role with more convincing health and environmental benefits.

Food of the future

Food of the future

Food production, especially animal-based food production, has a huge environmental impact. The livestock industry uses up one-third of habitable land on earth and is responsible for 14 percent of greenhouse gas emissions.17 By the end of this century, habitat loss and global warming are predicted to drive between one-third and one-half of all species to extinction.18 Even as humanity faces a climate crisis and biodiversity crisis, more food is needed to feed the global population, which continues to grow and is projected to reach 10 billion by 2050.

Those are the reasons many organizations and start-ups are working to develop alternative protein that is produced sustainably, uses fewer resources, and is free from hormones or antibiotics. Supertrends expert and founder of Big Idea Ventures Andrew Ive has called alternative protein “the most exciting category in food today”. The June 2021 Forbes article “The New Game-Changer for Alternative Proteins” provides further information on how fermentation combines a centuries-old process with modern technology.19

The growth phases of alternative proteins

Alternative protein is made possible by modern technology achievements such as gene editing, stem cells, 3D printing, or artificial intelligence. Most sectors in this field are at a late R&D phase. In a few years, we could witness alternative protein taking off commercially and eventually disrupting the traditional livestock industry.

The Supertrends alternative protein timeline

The Supertrends timeline (see below) is based on both knowledge- and expert-based prediction. Although a few of the milestones predicted on this timeline may be too optimistic and some may be too conservative, the overall trend is clear – alternative protein is the food of the future.

References

1. Novicio T., 10 Best Vegan Stocks to Buy Now. Yahoo Finance. 23 April 2021. https://finance.yahoo.com/news/10-best-vegan-stocks-buy-141155110.html

2. Hansen J., Singapore leads the future of food with world-first approval of cultured meat sales. Supertrends. 12 July 2020. https://www.supertrends.com/singapore-leads-the-way-in-a-future-of-meat-without-animals/

3. Good Food Institute. 2020 State of the Industry Report Fermentation: Meat, Eggs, and Dairy. Accessed on 19 November 2021. https://gfi.org/resource/fermentation-state-of-the-industry-report/

4. Allied Market Research. Dariy Protein Market. March 2021. https://www.alliedmarketresearch.com/dairy-protein-market-A05995

5. Specht L., An analysis of culture medium costs and production volumes for cultivated meat. The Good Food Institute. 9 February 2020. https://gfi.org/wp-content/uploads/2021/01/clean-meat-production-volume-and-medium-cost.pdf

6. Alphia. 2020 pet food trends: 6 ways manufacturers are using protein. Accessed on 22 November 2021. https://www.alphia.com/2020-pet-food-trends-6-ways-manufacturers-are-using-protein/

7. Okin G.S., Environmental impacts of food consumption by dogs and cats. Plos One. 2 August 2017. https://doi.org/10.1371/journal.pone.0181301

8. Wikipedia. Bioprocess. Accessed on 23 November 2021. https://en.wikipedia.org/wiki/Bioprocess

9. Good Food Institute. 2020 State of the Industry Report Fermentation: Meat, Eggs, and Dairy. Accessed on 19 November 2021. https://gfi.org/resource/fermentation-state-of-the-industry-report/

10. Good Food Institute: Investment insights Q3, 2021. Accessed on 6 December 2021. https://go.gfi.org/webmail/667193/355052473/98dc81ca8352693ca5c9fa8d8b05630c14c83c54b4623d731b2874735f89f2c1

11. Driebush C. Alternative-Milk Company Perfect Day Raises $350 Million, Prepares for IPO. The Wall Street Journal. 29 September 2011. https://www.wsj.com/articles/alternative-milk-company-perfect-day-raises-350-million-prepares-for-ipo-11632952800

12. Precision fermentation: How humans harness microbe-based biochemistry to make food more delicious. Economist. 13 October 2021. https://geneticliteracyproject.org/2021/10/13/precision-fermentation-how-humans-are-harnessing-microbe-based-biochemistry-to-make-food-more-delicious/

13. EUE-Lex. Genetically modified organisms — traceability and labeling. Accessed on 7 December 2021. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=LEGISSUM:l21170

14. Southey F. Combining precision fermentation with European cheese making. Food Navigator. 8 February 2021. https://www.foodnavigator.com/Article/2021/02/08/Alt-dairy-LegenDairy-applies-precision-fermentation-to-European-cheese-making

15. Hansen J., et al. Exploring cultural concepts of meat and future predictions on the timeline of cultured meat,

Future Foods, Volume 4, December 2021, https://doi.org/10.1016/j.fufo.2021.100041

16. Saint-Eve A., Irlinger F., Pénicaud C., et al. Consumer preferences for new fermented food products that mix animal and plant protein sources, Food Quality and Preference, 90 (2021) 104117. https://doi.org/10.1016/j.foodqual.2020.104117.

17. Food and Agriculture Organization of the United Nations. Key facts and findings. Accessed on 7 December 2021. https://www.fao.org/news/story/en/item/197623/icode/

18. Thomas, C., Cameron, A., Green, R. et al. Extinction risk from climate change. Nature 427, 145–148 (2004). https://doi.org/10.1038/nature02121

19. Kateman B. Fermentation: The New Game-Changer for Alternative Proteins? Forbes. 7 June 2021. https://www.forbes.com/sites/briankateman/2021/06/07/fermentation-the-new-game-changer-for-alternative-proteins/