Despite the enthusiastic and positive scenarios advanced by the marketing departments of the cultivated meat companies, in-vitro meat will not be the first choice for the vast majority of consumers, at least for the next decade. The industry still has to overcome cultural issues, misconceptions, religious constraints, a lack of information, and conservative mindsets (see Chapter 6.3). Based on a hypothetical choice experiment conducted by Peter Slade [14], “a mixed-logit model predicts that, if prices were equal, 65% of consumers would purchase the beef burger, 21% would purchase the plant-based burger, 11% would purchase the cell-based meat burger, and 4% would make no purchase.”

Pet food – an early target market? Especially in the West, pets are responsible for a significant part of meat consumption. In the US, pet food accounts for roughly one third of all meat consumption. Since the “Yuck Factor” (see below, Chapter 6.3.2) would not come into play here, pet owners could be among the first target groups of cultivated meat. On average, dogs eat some 211 kg of food per year, some 100 kg of which are of animal origin, and cats eat 98 kg, half of which is of animal origin. Land use for this feed production is about 2000 m² per dog and 1000 m² per cat.

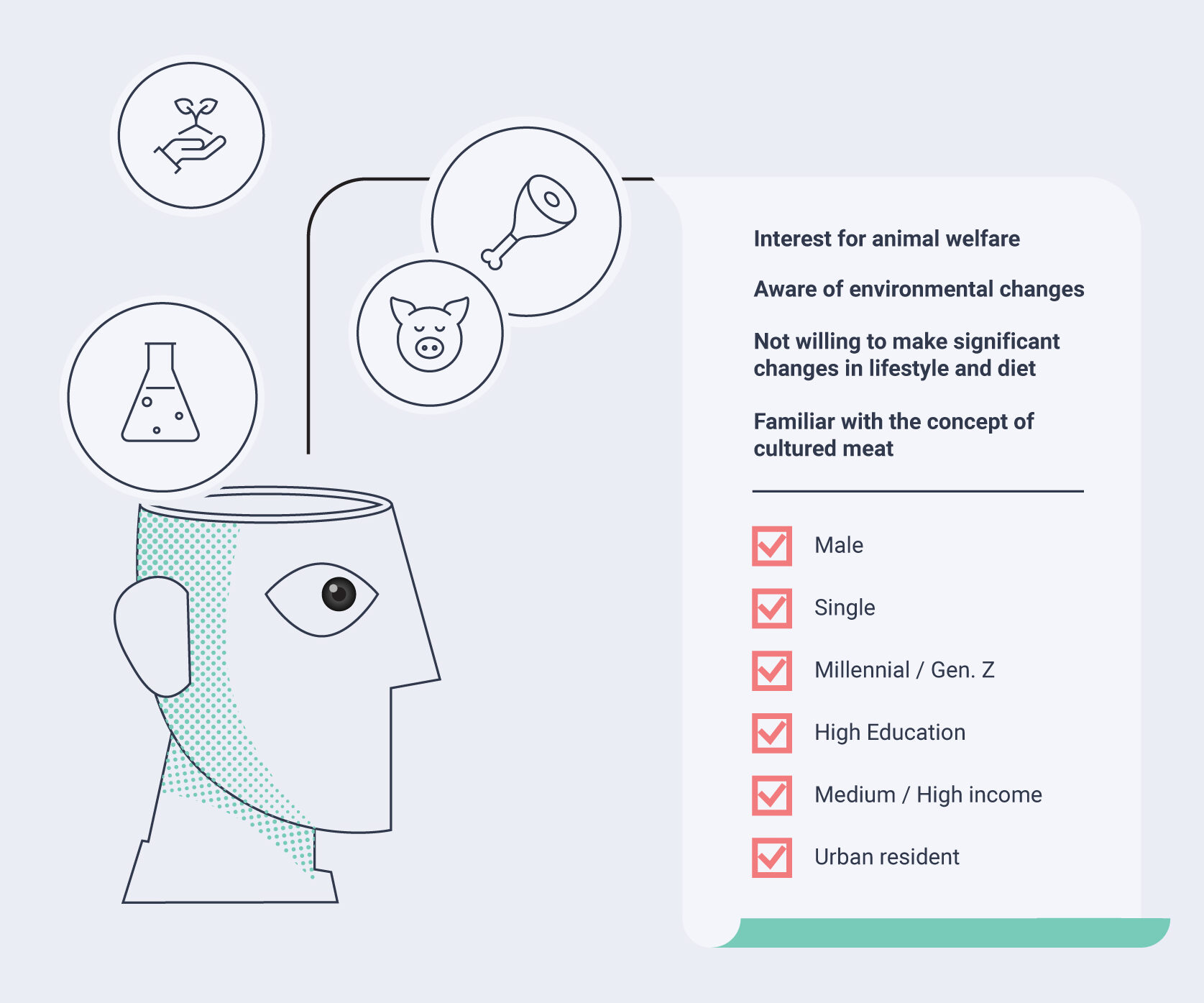

Consumer profile

Consumer profile

The development of a cultured meat industry depends on its capacity to onboard early adopters and create a growing community of cell-based meat eaters. Some of these will have shared values and worldviews, while others just want a cheap product.

There is no scientific consensus on the typical cell-based meat consumer. Existing studies have been conducted on a small scale, some lack representativeness, and most of them are based entirely on hypothetical questions, which are not a reliable predictor of human behavior (it is easier for people to declare a certain behavior in an imaginary situation, whereas in a real-life situation, their actual behavior will be different). Bekker et al. (2017) suggest that preferences regarding cell-based meat are not yet fixed and can still be influenced by the type of information disseminated.

Consumer predictors

Consumer predictors

However, a number of characteristics are considered to be predictors for cell-based meat consumption:

- Ethical and environmental preoccupations: Vegans, vegetarians, flexitarians, and omnivores who want to protect animals are more receptive to the advantages implied by cultured meat and are therefore more disposed towards trying it and supporting the idea.

- Male gender: Meat consumption has been associated in several studies with masculinity, the idea of power, pragmatism, and action-orientation. Therefore, men are less inclined than women towards vegetarianism and would prefer an alternative that does not involve giving up meat consumption.

- Younger age: cultured meat is considered to be appealing to millennials (born between 1980 and 1994) and to Generation Z (born between 1995 and 2015). Their heavy use of online media and social networks makes them more prone to consume information about innovations and food technology and more likely to identify with groups with shared interests, lifestyle, and habits. They are also more likely to be interested in following influencers and opinion leaders. Moreover, these generations exhibit a strong desire for flexibility and customization – needs that might dovetail with the anticipated possibility of being able to “design” the meat nutrient content according to their dietary preferences.

- Higher level of knowledge/education: Studies show that people with previous knowledge or interest in the field of cellular agriculture are also more willing to taste it and buy it. Given the complexity of the topic, this means the main potential consumer group could be limited to people with at least secondary education level.

- Health-consciousness: The idea of in-vitro meat might be more appealing to health-conscious people, who could be attracted by the promise of "clean meat" that is free of pesticides, antibiotics, and other chemicals. This group would be also highly receptive to the possibility of enriching meat with a perfectly balanced number of vitamins and minerals, as well as with the healthy types of fats. For instance, there may be a market niche for in-vitro meat that has been optimized to provide perfect nutrition for athletic consumers.

Impact of religion

Impact of religion

Along with these general characteristics, religious beliefs and cultural influences will have a strong impact on attitudes towards innovation and the dietary choices of consumers, especially regarding meat. Some Supertrends experts believe that these factors have been underestimated in discussions over the acceptance of in-vitro meat as a novel food.

Faith and the dinner table

Several religions have more or less strict prohibitions against eating meat or uphold vegetarianism as an ethical ideal. Others allow meat consumption, but have rules as to the types of meat and preparation that are permitted. Thus, there are three main questions to consider when assessing the market for cell-based meat in different religious communities:

- Is it meat?

- Is the meat derived from a “clean” animal?

- Has it been sourced and prepared in accordance with religious dietary instructions?

Buddhism and Hinduism are the two biggest religions that advocate vegetarianism to varying degrees. Together, they account for about 22 percent of the world’s population (1.6 billion adherents). Since the injunction against meat in these two faiths aims at avoiding the killing of animals, in-vitro meat might be considered acceptable.

In Islam (1.8 billion adherents, 24.1 percent of the global population), pork in particular is banned (haram), while other animals must be slaughtered and prepared in a lawful (halal) fashion.

Finally, in Judaism (14.5 million/0.2 percent), only certain types of meat are considered kosher, depending on the type of animal as well as the manner of butchering, processing, and preparation; additionally, dairy and meat products must be kept separate, so it is important to know whether cultivated meat is truly “meat” or should be considered pareve (“neutral”) for dietary purposes.

Open-minded authorities

For many religious authorities, the assessment of cultured meat remains an open question. In Islam and Judaism, the matter of whether the cells are sourced from a kosher or halal animal seems to be the central question.

Erdem Erikçi, co-founder and CTO of Turkish start-up company Biftek, told Supertrends in an interview: “Initially, people in Turkey hesitated to embrace the idea of lab-grown meat. However, their attitudes started to change as they learned more about it.”

Rabbi Menachem Genack, CEO of the kosher division of the Orthodox Union, the largest kosher certification and supervision agency in the world, said in a media interview: “Initially, I considered it to be pareve, but now that I have a greater understanding of the technology, it’s my position that clean meat is ‘meat’, and therefore it can’t be eaten with dairy.” [15] These and other statements [16] indicate that the matter remains unresolved for now, but that religious authorities are open-minded regarding in-vitro meat and continue to discuss the matter.

Cultural difference between west and east

Cultural difference between west and east

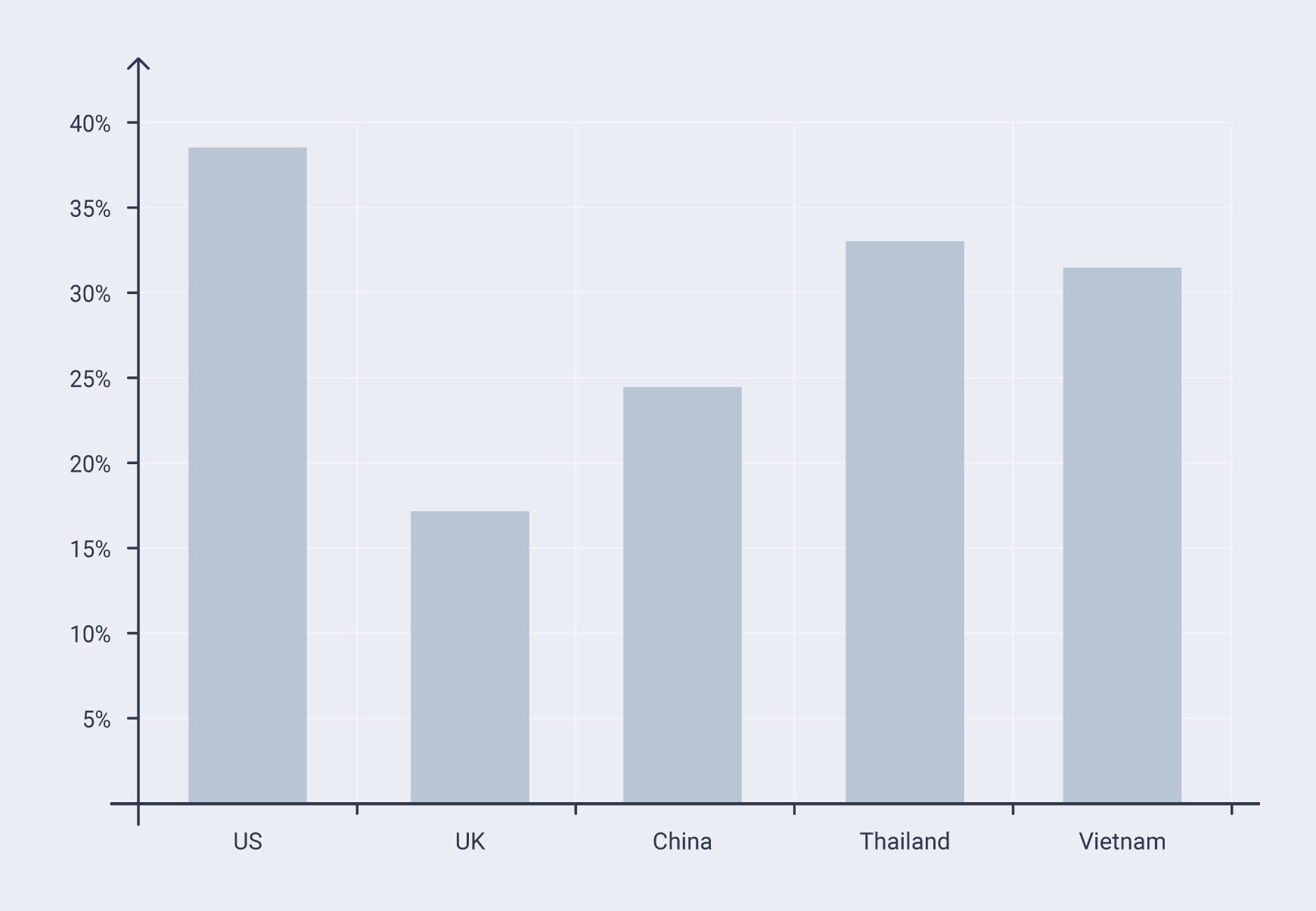

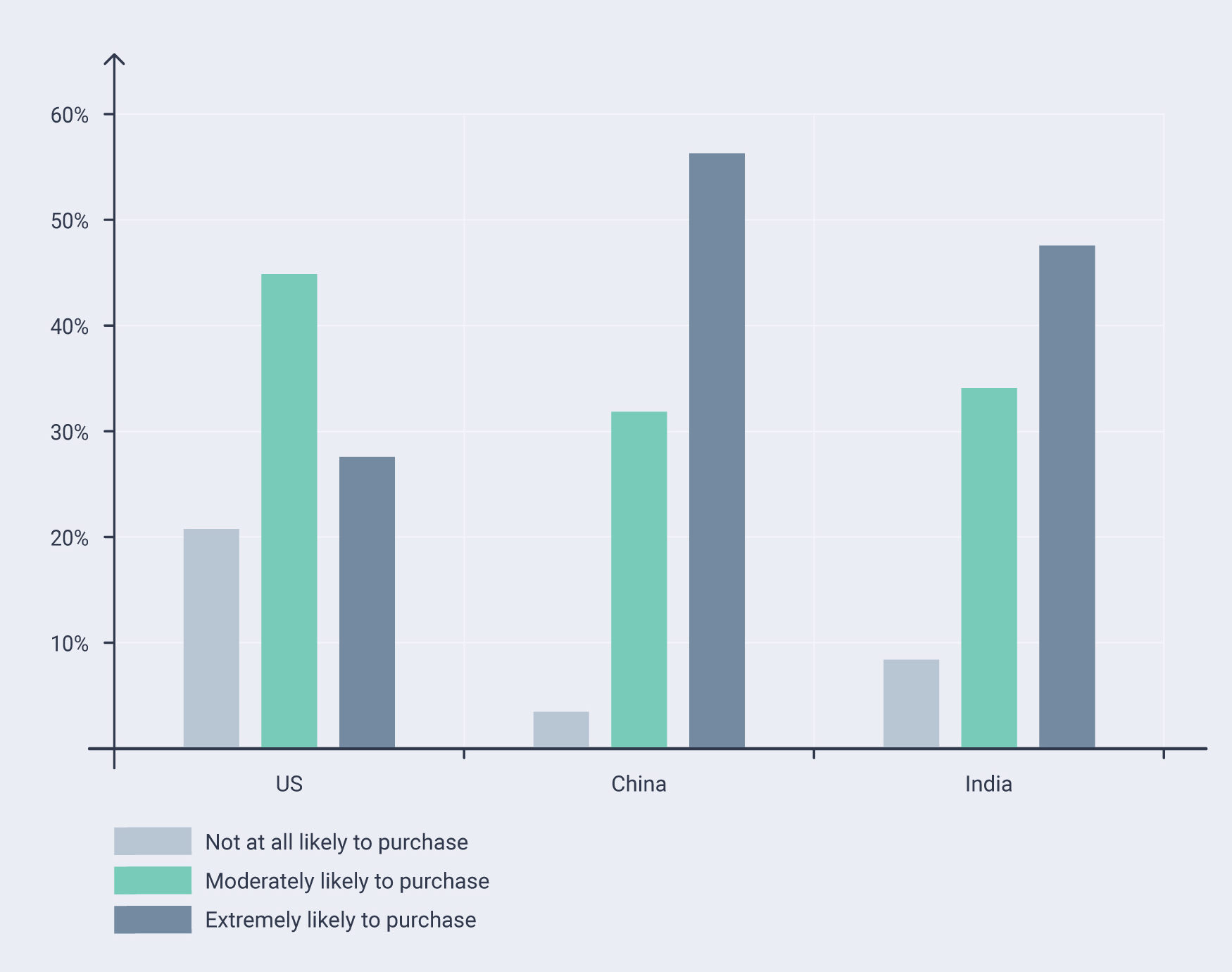

Given the population and the forecast increase in meat consumption in developing countries, Asian countries, especially China and India, are likely to be important markets for alternative protein products. Several surveys have been carried out across different countries to find out how cultural background might affect consumer acceptance of cultivated meat [17]. In the following, we will compare some recent surveys with samples of around 1,000 potential consumers.

Another online survey by Bryant et al. in 2019 compared respondents from the US, China, and India. They found that more candidates in China and India were willing to buy cultured meat than in the US [18]. However, it was pointed out in the report that the survey in China and India was geared towards urban-based well-educated candidates. Furthermore, we found that two other factors might have resulted in a higher percentage of acceptance in this study:

- The term “clean meat” was used instead of “cultured meat”. The Mandarin equivalent for the former term, as used in the Chinese survey, translates into English as “purity meat”.

- The same survey included a similar question regarding plant-based meat. This may have misled respondents, since consumers in Asia are quite familiar with plant-based protein.

From the above polls and other previous surveys [19];[20], we found that consumers in the US are consistently open towards the concept of cultivated meat, while acceptance levels among consumers in Asian countries are less clear-cut. Food safety is viewed as the most important factor determining acceptance of cell-based meat among consumers in India, according to a small poll (200 samples) done by one of the Supertrends experts.

Demographic factors that may influence regional markets

Some common factors should be taken into consideration for marketing strategies across countries, such as familiarity, perceived naturalness, political orientation, and price.

The followings are some demographic factors that should be taken into consideration for marketing strategies in the most important markets in Asia (especially in China and India) and in the US:

- Meat-eaters are most likely to purchase cultured meat in the US [21].

- Perceived healthiness predicted higher purchase intent in China [22].

- Messages about the environment and animal welfare may be more effective marketing strategies in India compared to China and the US [22].

- If safety is very well explained and ensured, the majority of consumers in India may be willing to try in-vitro meat.

Takeaways

Takeaways

We found significant differences between different consumer groups when it came to their potential motivation for choosing cultivated meat. The attraction of cultured meat seems to be influenced by a number of factors including ethical stance, gender, age, level of education, health-consciousness, and cultural and religious beliefs.

Faith-based choices regarding meat consumption are likely to be especially significant, in acccordance with specific dietary rules that form integral parts of the belief systems of the world’s major religions. Generally speaking, acceptance levels will vary between consumers in Europe and North America on the one hand and Asia on the other (“East” vs. “West”). Asian consumers prefer to see protein products like meat and seafood in their original shape. They like to see the whole piece of meat or even the whole animal, as opposed to processed meat. Price would be the most important factor in some countries in the East, particularly in the Middle East and India. Consumer acceptance of in-vitro meat largely depends on competitive pricing.

Finally, we have identified that key cell-based meat consumers are young males, have ethical concerns about the environment, are health-conscious, and have a higher level of education.

[14] Slade, P. 2018. If you build it, will they eat it? Consumer preferences for plant-based and cultured meat burgers. Appetite 125:428-37. doi:10.1016/j.appet.2018.02.030

[15] Watson, E. 2018. Orthodox Union: Cell cultured meat could dramatically lower the cost of kosher meat in future. Food Navigator. https://www.foodnavigator.com/tag/keyword/Food/kosher. Accessed: 23 April 2020.

[16] Hossain, M.S. 2019. Consumption of stem cell meat: An Islamic Perspective. IIUM Law Journal 27:1, 233-57. doi: 10.31436/iiumlj.v27i1.384

[17] Bryant, C.J. et al. 2019. A survey of consumer perceptions of plant-based and clean meat in the USA, India, and China. Frontiers in Sustainable Food Systems 3:11. doi: 10.3389/fsufs.2019.00011

[18] Bryant, C.J. et al. 2019. A survey of consumer perceptions of plant-based and clean meat in the USA, India, and China. Frontiers in Sustainable Food Systems 3:11. doi: 10.3389/fsufs.2019.00011

[19] Wilks, M. and C.J. Phillips, Attitudes to in vitro meat: A survey of potential consumers in the United States. PLoS ONE 12(2): e0171904. doi:10.1371/journal.pone.0171904

[20] Slade, P. 2018. If you build it, will they eat it? Consumer preferences for plant-based and cultured meat burgers. Appetite 125:428-37. doi:10.1016/j.appet.2018.02.030

[21] Wilks, M. and C.J. Phillips, Attitudes to in vitro meat: A survey of potential consumers in the United States. PLoS ONE 12(2): e0171904. doi:10.1371/journal.pone.0171904

[22] Bryant, C.J. et al. 2019. A survey of consumer perceptions of plant-based and clean meat in the USA, India, and China. Frontiers in Sustainable Food Systems 3:11. doi: 10.3389/fsufs.2019.00011