The regional landscape deserves special attention because certain regions and countries that are not traditionally suited for animal protein production can address their food security needs by producing cell-based meat. Some Supertrends experts suggest that widespread adoption of cultivated meat may lead to a decentralization of meat supply. In the future, major cities and regions may be supplied by their own cell-based meat production facilities.

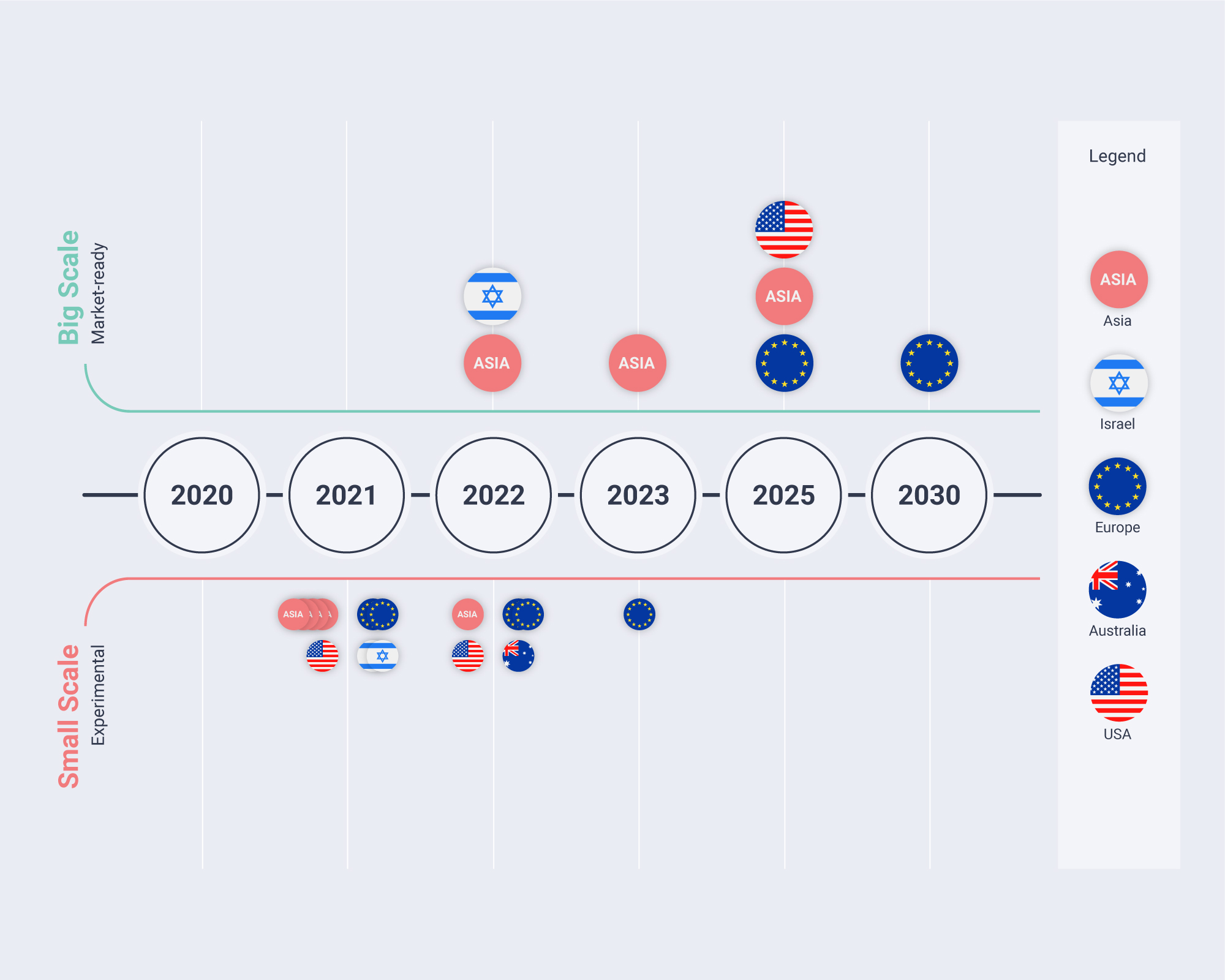

Some of the earliest and most established start-ups are based in the US and Europe, particularly the Netherlands and in Israel. Another active region is Asia, with the main actors being based in Singapore, Hong Kong, and Japan. These are also the regions that are most actively involved in cultured meat research.

"Cultured fish in the form of alternative fish protein may be available as a pilot B2B product by the end of 2021 or early in 2022." – Supertrends expert Carrie Chan, co-founder and CEO of Avant Meats (Hong Kong).

Cultured meat market

Cultured meat market

The food industry is undergoing accelerated transformations driven by demographic trends and cultural shifts that favor innovation. The evolution of the food market is also expected to be significantly affected by a geopolitical agenda that aims to ensure access to quality food for large segments of the population, by pressing environmental concerns, and by new technological advancements.

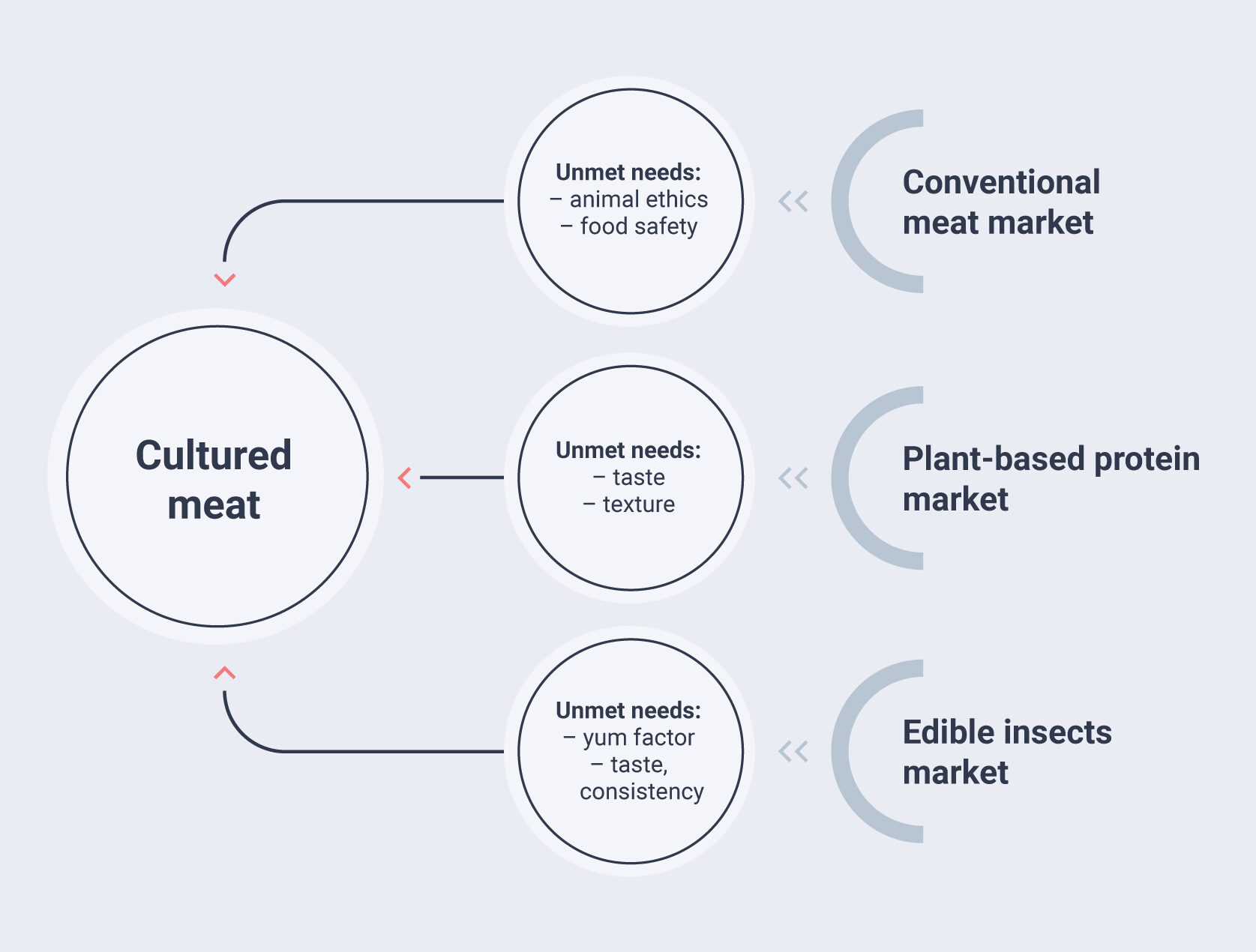

With its anticipated benefits, cell-based meat has the potential to meet the demands of a large category of consumers and fulfill the unmet needs of both omnivores and vegetarians. Even if traditional meat will not be replaced in the near future, the chances are high that cultured meat will take a share of the markets for conventional meat, plant-based protein, and edible insects.

Factors that drive the demand

- Increase in health and dietary concerns

- Population's access to information

- Increase in income

- Millennials and Generation Z's values

- "End Global Hunger" agenda

- Rising number of investors

- Technological advancements

- Growing demand for alternative protein

- The desire for flexibility and customization

- "Tribal influencers"

An under-considered but important aspect of this market distribution is the potential “addition effect” [7]. Despite the claim that in-vitro meat will reduce conventional meat production and its negative impact on the environment and animal welfare, there is also the possibility that cultured meat consumption will come on top of the existing dietary patters, thus increasing the environmental burden and disturbing the nutritional balance of the population.

Based on the global rise in meat consumption and on the increased demand for functional foods, various publicly available market research studies estimate that the in-vitro meat market will reach US$214 million in 2025 and US$593 million by 2032 (e.g., Research and Markets 2019). Inigo Charola, founder and CEO of Biotech Foods (a Spanish start-up focused on cultivated meat production), predicts that by 2040, cultured meat will account for 35 percent of all the protein consumed in the world [8].

Main market characteristics

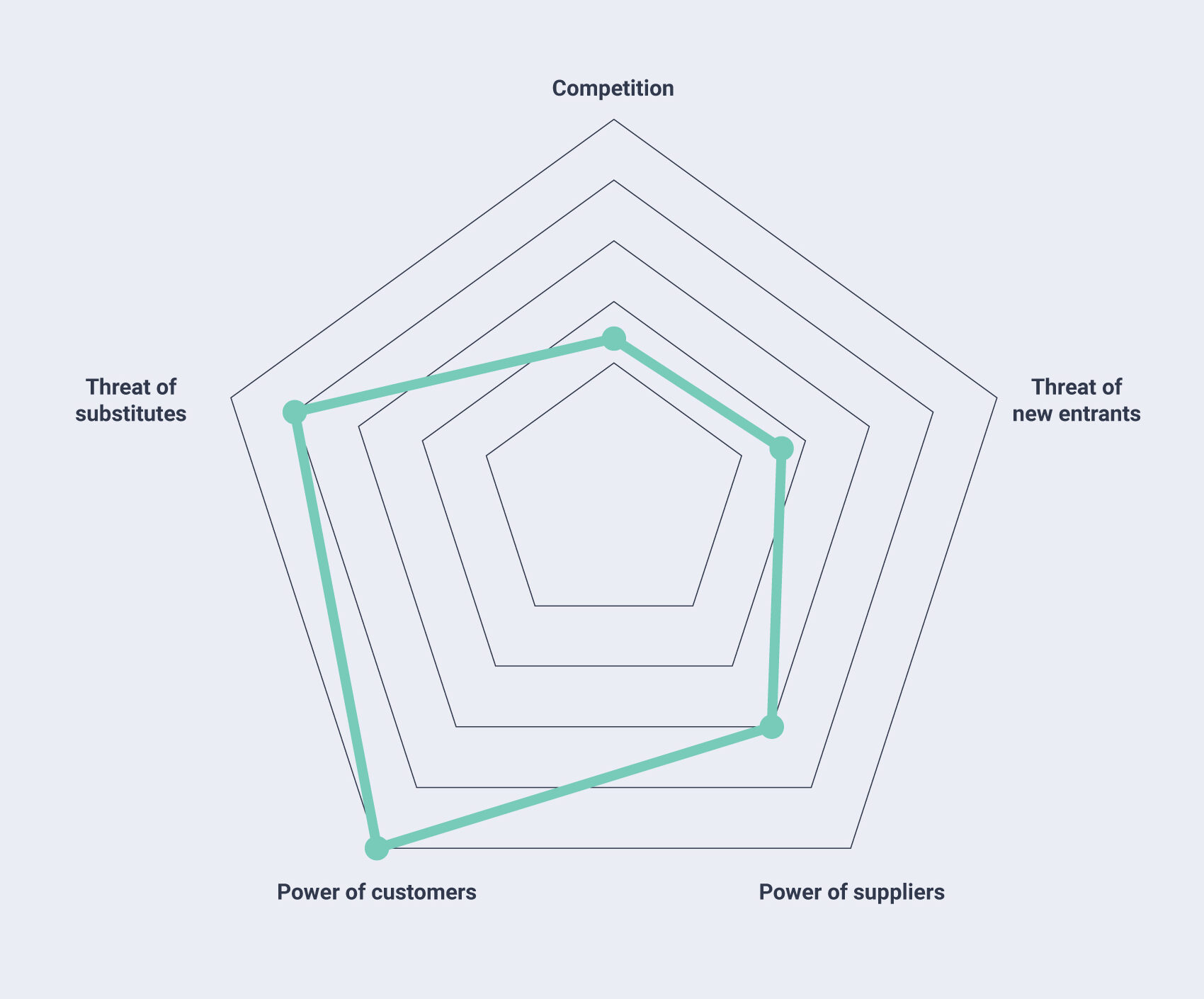

At this point, cellular agriculture in general and cell-based meat in particular can be considered an emerging niche market. The number of competitors is relatively low, while investors and capital funds demonstrate a rising interest in this area. The segmentation in terms of end-product and source allows the companies to find their own specialization and niche, which means that at this point, fierce competition inside the cultured meat market is avoided. Nevertheless, in order to become a viable alternative to conventional meat and plant-based protein, the in-vitro meat market must first become competitive in terms of price.

The companies already established in this field enjoy a stable position, the threat of new entrants being relatively low. Gaining a foothold in this industry requires a considerable investment in terms of time (e.g., research and development), money (e.g., equipment, appropriate locations), and skilled workforce (e.g., chemists, cell biologists, chemical engineers, technicians, food technologists, etc.).

In terms of suppliers, cultured meat companies rely mostly on providers of cell lines, growth medium (substances to feed the cells), scaffolds (the structure that determines the specific shape in which cells are grown), and bioreactors. Sourcing the necessary cells for cell-based meat is mostly a matter of research and experiments in order to find the best raw materials, since the number of suppliers in this field is relatively high.

Production cost drivers

Growth medium, on the other hand, is considered to make up 80 percent of the end-product cost, since some ingredients such as growth factors are very costly and difficult to obtain, especially for large-scale production (see Chapter 4 for more details). Moreover, given that different types of cells need different nutrients to develop, there is no universal growth medium that is suitable for all types of meat, making the procurement process even more difficult [9]. The scaffolds must also be individually adapted to the type of end-product that each company is aiming to develop (e.g., fillet steak), which will also increase the power of suppliers, unless companies decide to produce them in-house.

Even though bioreactor technology is already used in the medical field, existing bioreactors are only suitable for research purposes and not for large-scale production. Moreover, they also have to be adapted for cultivation of the intended type of meat, making the entire process of scaling up highly dependent on the bioreactor suppliers.

Market segments

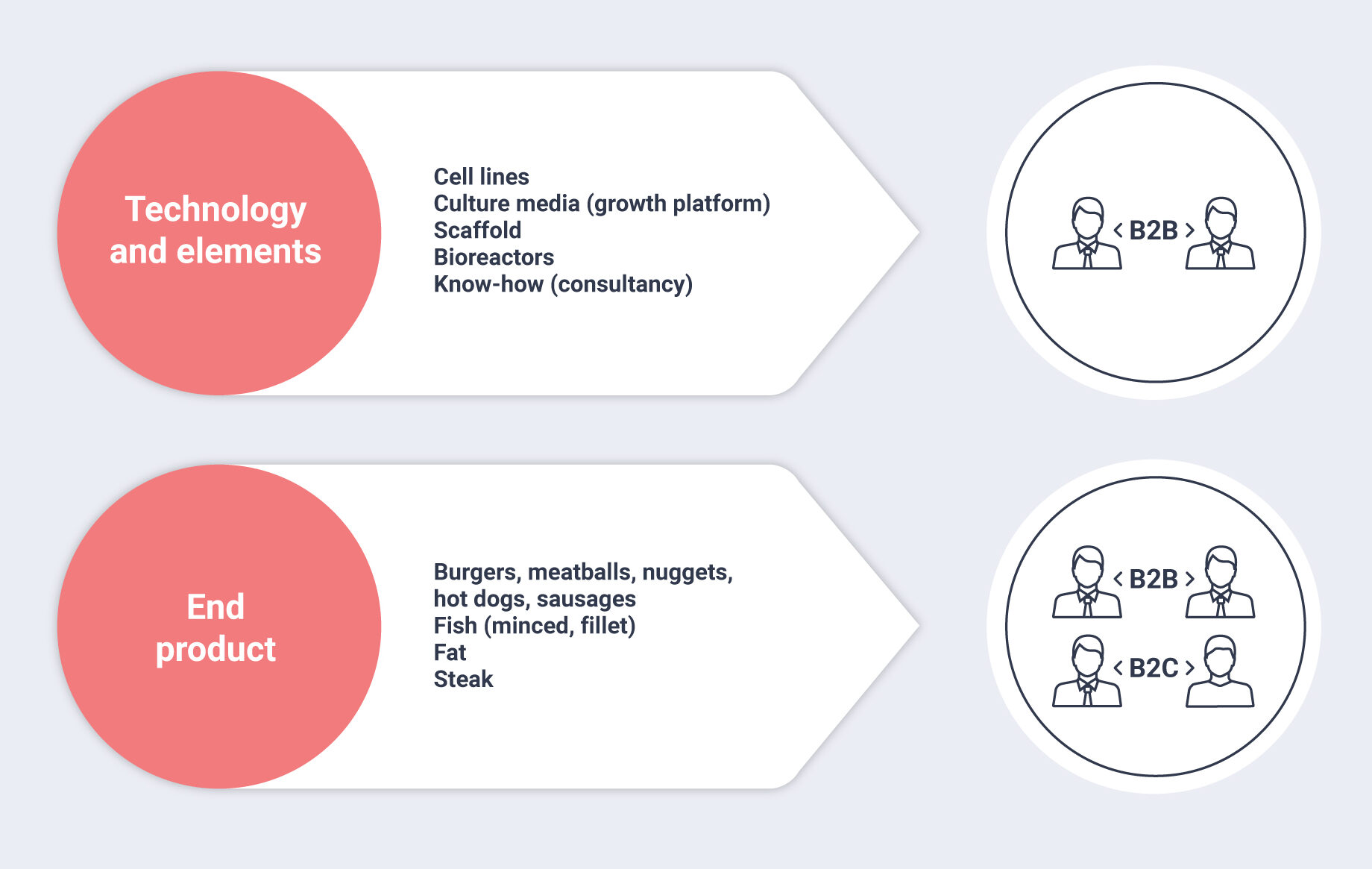

Despite occupying an emerging niche, the in-vitro meat market has significant potential for expansion. On the one hand, there is the commercialization of know-how, technology and of essential elements for cultured meat production. Some start-ups already active in this field are planning to build and sell bioreactors (e.g., Cellular Agriculture, UK), scaffolds (e.g., Matrix Meats, US), or growth platforms (e.g., Future Fields, Canada) targeted at the companies that produce cell-based meat.

On the other hand, cultivated meat producers focus on commercializing different types of meat and fats, while targeting either other businesses (e.g., restaurants, fast-food industry) or customers directly. Hotels and restaurants, especially those in the fast-food industry, are especially keen on processed meat products such as burgers, meatballs, nuggets, hot dogs, or sausages, etc. Since they can easily be integrated into ready-to-eat products, they are also of interest to supermarkets and food retailers.

From this perspective, each market sub-group has its own characteristics and involves a specific business strategy as well as particular production and operations processes.

Market segments by source

When considering the source of cells to be used for the culture, the market can be currently segmented largely into fish and seafood, beef, poultry, and pork. According to predictive market studies [10], the poultry segment is perceived as having the highest potential to gain market share, due to the expected lower price compared to other types of cell-based meat; the popularity of chicken nuggets and their increased visibility through the fast food chains such as KFC; and the rising demand for chicken meat, especially in developing countries. Shir Friedman, marketing representative of Israeli cultured meat startup SuperMeat, has declared that the company will be focusing exclusively on chicken because “it is the second most popular meat worldwide next to pork and because it would save more animals from slaughter” [11] At least two more companies (Appleton Meats in Canada and Memphis Meat in the US) are targeting the same market.

As an alternative opinion, Supertrends expert Mirko Betti, Professor of Agricultural Life and Environmental Sciences at the University of Alberta, Canada believes that chicken meat will be one of the last cultured meat products to become available in supermarkets. On the one hand, he notes that the lower levels of micronutrients and myoglobin of chicken meat make it comparatively easy to create an in-vitro analogue with the same nutritional value. However, traditional chicken meat is also one of the most efficient products in terms of feed conversion (1.6 kg of feed per 1 kg of broiler chicken), which will make it difficult for the cultivated meat industry to achieve price parity in this segment.

Market segments by end product

When we look at the current distribution of companies active in the field of cultured meat, we can pinpoint certain areas with high innovation potential and with the highest customer acceptance. North America and Europe in particular benefit from advanced infrastructure and high investments in research and development.

Investment in plant-based burgers can spur cell-based meat growth

Many big players contemplating the nascent cultured meat market may feel inspired by the boom of plant-based meat analogues. When Beyond Meat, producer of the vegetarian Beyond Burger, went public in 2019, the company was valued at close to US$1.5 billion. Furthermore, in 2020, Impossible Foods, which makes another burger based on imitated meat, reportedly raised money based on its valuation at nearly US$4 billion.

In the cultivated meat market, established players such as Just, Inc. (US) and Mosa Meat (EU) have already managed to attract considerable funding from investors and have initiated lobbying and awareness campaigns to inform and educate public opinion. Similar activities are underway in Israel, the self-proclaimed "most promising land for cultured meat" [12], where the cultivated meat industry is trying to gain acceptance among the various religious communities.

Broad product palette

The most active players in cultured meat are startup companies working on developing cell-based beef, chicken, pork, fish and seafood, fat, and milk, as well as those that are working on developing technologies in growth media, bioreactors, computer modeling, and similar fields. Almost all of these startups are located in North America, Europe, or Asia. Some of the types of cell-based products that companies intend to develop and commercialize are:

- Fats (Cubiq Foods, Spain; Mission Barns, US; Future Meat Technologies, US; Peace of Meat, Germany)

- Chicken (Super Meat, Israel; Memphis Meat, US; Clear Meat, India)

- Beef (Appleton Meats, Canada)

- Pork (Higher Steaks, UK; New Age Meats, US)

- Fish (BlueNalu, Wild Type, US)

- Foie gras (IntegriCulture, Japan)

- Kangaroo (Vow, Australia)

- Human milk (Turtle Tree Labs, Singapore)

- Collagen (Avant Meats, Hong Kong)

- Liver (Peace of Meat, Germany)

- Meat for pet food (Because Animals, US)

Additionally, the technology itself constitutes a significant sector within the cultivated meat market, with several companies working to commercialize the various components of cultured meat infrastructure, including:

- Bioreactors (Cellular Revolution and Cellular Agriculture, UK; Super Meat, Israel)

- Growth media (Future Fields, Canada)

- Scaffolds (Matrix Meats, US)

- 3D meat printers (Nova Meat, Spain)

Companies by region

Companies by region

The most active players in cultivated meat are startup companies working on developing cell-based beef, chicken, pork, fish and seafood, fat, and milk, as well as those that are working on developing technologies in growth media, bioreactors, computer modeling, and similar fields. Almost all of these startups are located in North America, Europe, or Asia. To a certain degree, the type of end-product that each company specializes in reflects customer preferences and market demand in that specific region. Companies in the US, Europe, and Israel focus mostly on cultured beef, poultry, and fats, while companies in East and Southeast Asia target specifically cultured fish and seafood, and Australian companies hope to gain market share with kangaroo meat. Interestingly enough, cultured fish seems to be a preferred market segment in the US as well, since two out of 13 companies in this region are in a late development phase for this type of product. The following overview of companies by region is non-exhaustive.

North America

United States

Although the first successes in terms of cell-based meat production were achieved in Europe, there has been a steep increase in the number of startups registered in the US. This development was supported by the constantly increasing demand for meat in this region, but also by a culture and mentality that is especially open to innovation and willing to experiment with new ideas. The industry’s growth in the US was further fostered by the efforts of New Harvest (a non-profit organization) to promote and support in-vitro meat research.

The players in this region are at different stages of development, ranging from companies that have already achieved results and conducted tastings (Modern Meadow, Just, Inc., Wild Type and Finless Foods, New Age Meats) to startups in the research and experimental phase (Matrix Meat and Mission Barns). Some other companies (e.g., Balletic Foods) choose to operate in stealth mode, with no plans or developments publicly announced.

Canada

Canada is home to Future Fields, a company that is already established on the market and creating custom growth media platforms for cellular agriculture. Another company, Appleton Meats, aims to supply the Canadian market with cultured chicken, beef, and cultured food for pets sometime between 2022 and 2024, though it is currently still in the development phase.

Europe

Although Mark Post, a professor at Maastricht University, created the first burger from cultured cells, Europe’s leadership position in terms of cultured meat research has been undercut by a lack of funds and governmental support. Nevertheless, the region still has several active companies whose activities are focused on three main areas: developing fats and cell-based meat to be used in other structured and non-structured meat products, the development of bioreactors and 3D printers, and production of cultured foie gras. Three of them (Mosa Meat, Peace of Meat, and Meatable) plan to bring their cell-based products to the market in 2022.

Middle East and Asia

Israel

Despite its small size, Israel hosts four active companies in the field of cell-based meat, which mainly focus on beef and chicken as sources for their end-products. The Israeli company Aleph Farms gained a great deal of attention when its “lab-grown minute steak” was produced by a 3-D printer on the International Space Station in September 2019.

Turkey

Turkish startup Biftek is the only cultured meat company based in a predominantly Muslim state, which has given it an advantage in pursuing Halal certification. The company is seeking investment to enable it to scale up its cultured beef product.

Singapore

There are five active Asian players in the cellular agriculture market. Singapore is actively promoting R&D activities in alternative protein, and two of those companies – Shiok Meat and Turtle Tree Labs – are based in Singapore. Shiok Meat is working on production of cell-based shrimp. Like other Asian companies, including Avant Meat in Hong Kong (see below), it is very much tailored to the local market. Most of the Asian players are working to quite ambitious schedules. Shiok Meat has told media that the company is looking to bring its product to the market as early as 2021, which could make it the first company to launch a cell-based meat product in the world. Turtle Tree Labs is also aiming to launch its product in the latter part of 2021. Their product is cell-based human milk, which will be marketed as a B2B product to be licensed to other companies producing baby formulas.

China

So far, in-vitro meat seems not to have attracted a lot of attention in China. It was reported in 2017 that China was planning to invest US$300 million in Israeli cultivated meat technology. However, there have been no further reports in this connection in the last two years.

Avant Meat is a cultured fish company based in Hong Kong. It aims to bring its first product – cultivated fish maw – to the B2B market in late 2021 or the beginning of 2022, and to offer cultured fish on the retail market in late 2022 or early 2023. Supertrends expert Carrie Chan, who is the co-founder and CEO of Avant Meat, announced in March 2020 that her company would reduce production costs by 90 percent within 12 months while scaling up the capacity.

Japan

Two Japanese companies are active players in the cultured meat market, namely Nissin Foods and IntegriCulture.

IntegriCulture is mainly aiming to develop two products. The first is space salt, a powdered version of growth media. It was reported that space salt can be used as a salt seasoning both for space missions and for daily life. The second is a cultured foie gras (cultured duck liver) product, which it plans to launch in restaurants in 2021, and on the retail market in 2023.

The second Japanese business is instant ramen giant Nissin Foods, which is partnering with the University of Tokyo to develop small cell-based meat cubes to include in their freeze-dried ramen packs.

India

Clear Meat is the only startup company in India working on in-vitro meat. It aims to make its cultured chicken product commercially available in India in 2022.

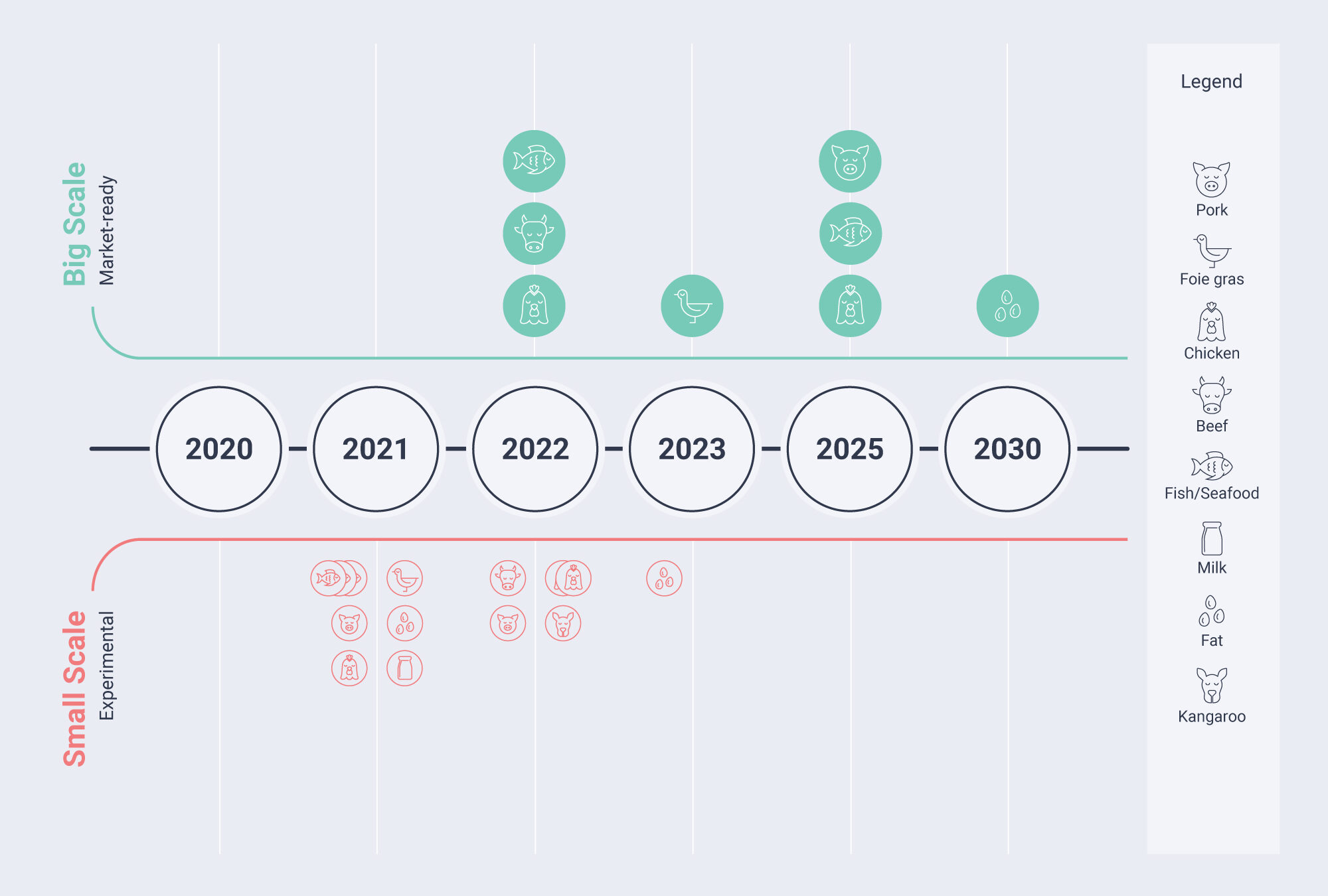

The above collective timeline is based on research and Supertrends expert interviews. It shows that the first commercial cultured meat is likely to be available in 2021, in Asia. This may be a small-scale product sold to restaurants under a B2B arrangement. Based on this timeline, it appears that cell-based meat will be available on a large scale in about 2024 or 2025. It would probably be sold in supermarkets around the world. However, some Supertrends experts have voiced concern that due to the COVID-19 pandemic, this timeline may be pushed back for a period from a few months up to three to four years.

Regulatory bodies

Regulatory bodies

While start-ups are racing to get the first scaled-up products out, the question of securing approval from the regulatory bodies still remain. Without proper regulation, companies will not be able to bring cultured fish, shrimp, beef, milk, or other protein to supermarket shelves and consumers’ dinner tables.

In the past, the world has often looked to the US and the EU when it came to regulation of products based on new technologies. However, it seems that in the case of in-vitro meat, Asian countries, especially Singapore, China, and Japan, are taking the lead in regulation.

Regional regulations

United States

Since cultured meat originates from livestock and would likely be sold alongside traditional meat products, it appears to come under the jurisdiction of the U.S. Department of Agriculture (USDA). However, the process of growing it in bioreactors in a lab involves techniques that are currently regulated by the U.S. Food and Drug Administration (FDA).

In November 2018, the USDA and the FDA issued a press release articulating a joint framework for robust collaboration, wherein the FDA would oversee the stages of production from cell collection to differentiation, while the USDA would regulate all subsequent processing, packing, and labeling of the products. A memorandum of understanding was released in March 2019. In December 2019, the US Senate introduced a bill to formalize a joint framework for regulating meat products cultivated from cells, bringing cell-based meat one step closer to the grocery shelves.

Canada

Canada is still determining regulation of cultured meat as a novel food; however the current Food and Drugs Act does not mention regulation thus far. A document produced by the Canadian Agri-Food Policy Institute titled “Friend or Fiend: In vitro lab meat and how Canada might regulate its production and sale” suggests: “In vitro meat may be regulated as a novel food since it falls into the three domains of novel food classification according to the Food and Drugs Regulations: no history of safe use, novel process and potentially genetically modified.”

European Union

In the EU, current regulations and policies are largely supportive of investments and innovation in alternative proteins. In 2012, the European Commission adopted the strategy "Innovating for Sustainable Growth: A Bioeconomy for Europe". This strategy proposes a comprehensive approach to address the ecological, environmental, energy, food supply, and natural resource challenges. In 2015, FOOD 2030 was launched as a policy to deliver a climate-smart, sustainable food system in Europe. If its environmental sustainability and other health benefits are proven, cultivated meat could be an important pathway to making the Food 2030 Initiative a success. The possible steps for in-vitro meat to gain regulatory approval in EU could be:

- Novel food regulation: Cultured meat falls within the scope of the EU Novel Food Regulation. Therefore, it would require pre-market authorization from the European Commission to make sure that it is safe, properly labeled, and has sufficient nutritional value.

- EU-level approvals: The second stage would be approval by the European Food Safety Authority (EFSA), although it is not yet clear what type of nutritional and toxicological evidence EFSA would require to approve cultivated meat. It is also subject to the European Commission's General Food Law Regulation.

- State-level legislation: Inspections and enforcement would likely be carried out by member states.

Singapore

Singapore is among the countries where the authorities are taking the most proactive steps in regulating alternative protein. The state launched the Singapore Food Story (SFS) in 2019. “This movement will strengthen Singapore's food security and position Singapore as a leader in science and technology in the areas of sustainable urban food production, bio-based protein production – this is where cultured meat comes in –, and food safety science,” according to Supertrends expert Paul Teng.

The Singapore Food Agency (SFA), the same agency that launched the SFS, published Guidance Information on Safety Assessment of Novel Foods in November 2019 with detailed requirements for the safety assessment of cultivated meat.

China

In mainland China, regulations for artificial meat are still limited to plant-based meat. A safety assessment of cell-based meat is largely lacking. Hong Kong with its free-market system has a reputation for being more flexible when it comes to food regulation. The Centre for Food Safety (CFS), which operates under the Hong Kong Food and Environment Hygiene Department (FEHD), is responsible for implementing territory-wide food safety policies and enforcing food-related legislation. The two pieces of legislation governing food regulation are the basic food law and the Food Safety Ordinance.

Japan

The main law that governs food quality and integrity in Japan is the Food Sanitation Act (FSA), while the Food Labelling Act offers comprehensive regulation on food labeling. It is not yet clear which information will be required for the safety assessment of cultured meat.

When asked about the regulation and legislation for in-vitro meat, Supertrends expert Can Akcali predicted that legislation would move forward faster once the product is available. This might be the case within one or two years, by which time commercial-scale production will likely have begun.

Sustainability programs as accelerators for cultured meat adoption

The main determining factors for the future of in-vitro meat will be technological maturity, regulatory approval, customer acceptance, and its ability to compete commercially with the existing meat industry. However, an important catalyst could be the extent to which cultured meat is viewed as a way of achieving national, regional, and global targets in terms of food security, climate change mitigation, and other sustainability goals. While discussing sustainability goals on a country-by-country basis would exceed the scope of this report, we may mention a few initiatives on the regional and global levels that impinge on the prospects for cultivated meat.

Regional initiatives

As noted above, the EU is currently considering how cultivated meat could be part of its greenhouse gas (GHG) reduction program as well as its efforts to feed its citizens in an environmentally sustainable manner. Other EU initiatives that could benefit from cellular agriculture include those geared toward stewardship of natural resources, e.g., the MedFish4Ever Declaration on management of Mediterranean fish stocks, which aims to support sustainable small-scale fisheries and aquaculture. This program is closely linked to the efforts of the FAO’s General Fisheries Commission for the Mediterranean (GFCM) to make Mediterranean and Black Sea fisheries more sustainable.

Similar sustainability programs exist in the ASEAN region that aim at enabling innovation as a cross-cutting priority for sustainable development. A UNDP report in 2019 advocated the “indivisibility of the SDG [UN Sustainable Development Goals] and the interconnectedness of economic growth, environmental sustainability and social development for all. This will need new ways of developing and delivering goods and services, including through technology – from food supply to health care and from water and sanitation to education” [13]. Clearly, such efforts could also act as accelerators for the widespread adoption of cultured meat.

The 2030 agenda and UN sustainable development goals

In 2015, as part of its 2030 Agenda for Sustainable Development program, the UN adopted a set of 17 Sustainable Development Goals (SDGs) that are designed to bring about long-term peace and prosperity to all countries, both industrialized and developing. The financial expenditures required to achieve these ambitious goals are subject to controversial debate and have been estimated by the UN Conference on Trade and Development (UNCTAD) at US$2.5 trillion per year. Whatever the final price tag may be, it is certain that UN member states, international financial institutions, and private donors will be seeking cost-efficient ways of achieving the SDGs, including novel technologies that can help bring about global transformation.

There are seven SDGs in particular that in-vitro meat could help to bring about; these are:

- SDG 2 – Zero Hunger

- SDG 3 – Good Health and Well-Being

- SDG 9 – Industry, Innovation, and Infrastructure

- SDG 12 – Responsible Consumption and Production

- SDG 13 – Climate Action

- SDG 14 – Life Below Water

- SDG 15 – Life on Land

Takeaways

Takeaways

The main questions when anticipating the future development and growth of the cultivated meat market are which products are most likely to be the earliest on the market, as well as when and where they will first be available. Based on Supertrends data and media reports, it is likely that the first B2B products will be cultured fish (and seafood), milk, fat, or chicken, and that they will first become available in Asia.

The regulatory bodies in the US, Europe, and Asia are considered to be generally supportive of protein products cultivated from animal cells. We found that the most detailed requirements for the safety assessment of cultivated meat were issued by the authorities in Singapore. Consumer acceptance must be given ample consideration, especially in regions where the consumption of animal protein is strongly influenced by religion and culture. Regulation and approval of cultured meat could vary considerably between markets and regions and will be governed not only by health and safety considerations, but also by the contribution in-vitro meat can make to the achievement of national, regional, and global policy goals.

Religious leaders seem to have an open mind regarding cultured meat, which is an important factor for consumer acceptance in those regions.

We also found that consumers in the East rated health and food safety as more important factors than consumers in other regions did.

References

[7] Stephens, N. et al. 2018. Bringing cultured meat to market: Technical, socio-political, and regulatory challenges in cellular agriculture. Trends in Food Science & Technology 78:155-66.

[8] Morrison, O. 2019. Biotech Foods discusses cultured meat trend. Accessed: 31 March 2020. https://www.foodnavigator.com/Article/2019/11/05/Biotech-Foods-discusses-cultured-meat-trend.

[9] Bomgardner, M. 2018. The to-do list for ‘clean’ meat. Chemical and Engineering News 96(42).

[10] MarketsandMarkets 2020. Cultured meat market. Accessed: 2 April 2020. https://www.marketsandmarkets.com/Market-Reports/cultured-meat-market-204524444.html.

[11] Blum, B. 2016. Real chicken even a vegan could love. Accessed: 31 March 2020. https://www.israel21c.org/real-chicken-even-a-vegan-could-love/.

[12] Banis, D. 2018. How Israel Became The Most Promising Land For Clean Meat. Accessed: 10 April 2020. https://www.forbes.com/sites/davidebanis/2018/10/17/how-israel-became-the-most-promising-land-for-clean-meat/#7f2622c651cb.

[13] Smetana, S. Et al. 2015. Meat Alternatives: Life Cycle Assessment of Most Known Meat Substitutes. The International Journal of Life Cycle Assessment 20(9):1254–67. https://doi.org/10.1007/s11367-015-0931-6.