Based on Gartner’s hype cycle, which aims to visually represent the maturity of emerging technologies, quantum computing currently appears to be at its peak. The first-generation products are already on the market, there is a lot of media coverage on this topic, and early adopters have already started to experiment with the technology. The number of companies developing products and services in this sector is constantly increasing.

Based on a market survey coordinated by the Quantum Economic Development Consortium in the US, it is expected that revenues from quantum computing-related activities will reach US$320 million in 2020 and US$830 million by 2024, the main revenue sources being the provision of quantum services via cloud and the commercialization of devices, software, and services.69

Many companies have emerged as spin-offs from university research centers. Another important source of start-ups is the Creative Destructive Lab, a nonprofit organization with offices in Canada, the US, France, and the UK that offers mentorship, opportunities to raise capital, and business development support.

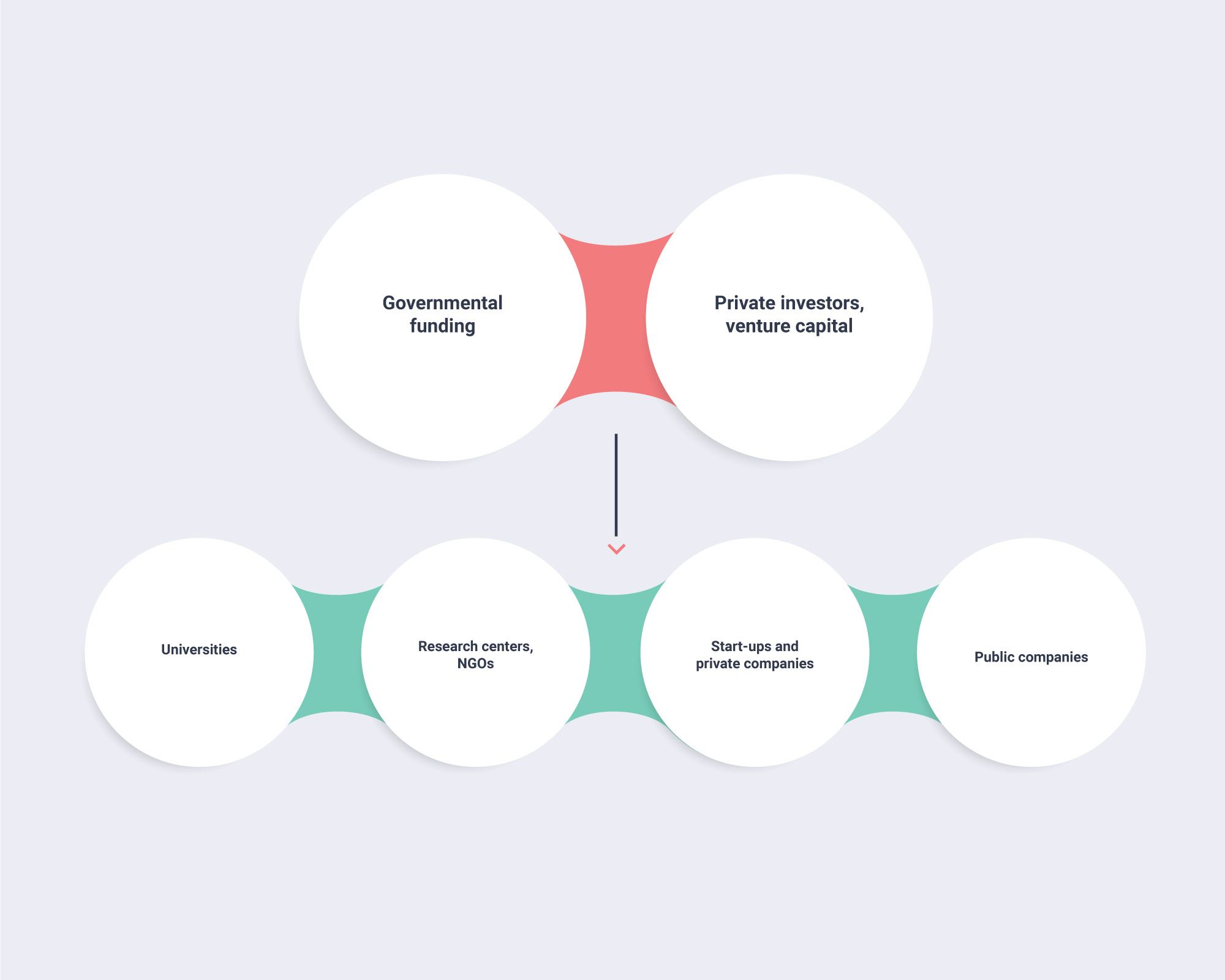

The main sources of funding in this field are governments and private investors. Universities and research centers are largely financed by governmental programs and, to a lesser extent, businesses. Established public and private companies cover most of their quantum computing research and development expenses themselves, while start-ups build up their services with contribution from investors and, occasionally, governmental grants.

Quantum computing technology has attracted investment from many different areas. Companies in the information technology, defense, and pharmaceutical sectors as well as universities are all interested in the potential of these technologies. There are plenty of start-ups that make use of this technology in one way or another and are attracting the interest of venture capital firms and individuals eager to claim a stake in quantum technology development. We have separated these investor groups into two categories, public and private. Information on public investment can be gleaned from communications required by transparency rules, from press releases, and from academic research, and is thus more easily available than data from the private sector, which is much more secretive due to competitive pressure and related considerations.

In this chapter, we will present the main investors in the public and private sectors. This information will be very helpful in mapping the locations that have highest quantum investment, which translates into an advantage in the ongoing quantum race.

Governmental investments

Governmental investments

There is a consensus between private organizations and governments on the importance of developing quantum technologies, as evidenced by the large quantities of money invested in quantum research and development by venture capitalists and companies, but also by government agencies such as ministries of defense, energy, and education. Additionally, some countries are assigning considerable funds from their national budget to quantum research and innovation.

However, it is not only individual countries that have been investing in funding local initiatives of quantum computing. The EU has also made a notable contribution to R&D in the field of quantum technology across the bloc. This has allowed European countries such as Spain and Germany to complement their domestic budgets for quantum development. Switzerland, and the UK – European states that are not EU members – have also allocated substantial budgets to quantum technology from public funds.

Within the EU’s €80 billion Horizon 2020 research and innovation program, €1 billion has been allocated to the EU Quantum Technologies Flagship initiative, which currently funds 20 projects in the areas of quantum computing, simulation, communication, metrology and sensing, and fundamental quantum science. Each of these will receive approximately €10 million for a duration of three years, except the programs in fundamental quantum science, which will receive €2-3 million.70

Another agency that contributes complementary funding in Europe is the European Research Council, which also provides special lines of financing for quantum computing projects.

Between 2014 and 2019, the UK also invested £1 billion in the development of quantum technologies through its National Quantum Technologies Programme.71

Asia

Asia has seen strong quantum investment, notably in China, Russia, India, Japan, South Korea, and most interestingly, Singapore, which despite its small size sees a great deal of public investment in technology and quantum computing. In the Middle East, Israel’s ministries of defense and education are sources of significant public investment. Iraq has a public quantum institute, but there is no information concerning the investment volume in this project. The Indian government has pledged considerable funds for quantum computing research through its National Mission on Quantum Technology as well as the Department of Science and Technology.

In accordance with its aim of becoming a science and technology superpower, China aspires to lead “the second quantum revolution”72 and has directed a large volume of funds towards quantum applications in economic and military projects. Significant breakthroughs are envisioned by 2030.

Between 2009 and 2019, Chinese quantum information research was mainly funded by central and local governments, reaching around US$987 million in total. Lately, most of the funds have been going towards the construction and operation of the Innovation Institute for Quantum Information and Quantum Science & Technology that was founded in Hefei in 2017 with the support of the Chinese Academy of Sciences and Anhui Province. Besides the 7 billion yuan (US$1.04 billion) that have been planned for the first phase of the institute's infrastructure construction, the province will provide another 10 billion yuan through a specific fund to promote industrial development in the field of quantum science.73

Russia has a strong quantum program, as the government has investments in both the Russian Quantum Center and the NTI Quantum Technology Center (and its spin-off, the NTI Center for Quantum Communications).

Russia’s US$790 million (₽500 billion) investment marks the country’s official entry in the quantum race.75

In 2019, India set up the Quantum-Enabled Science & Technology (QuEST) research project within the Department of Science & Technology (DST) and allocated 80 crore rupees (US$11.2 million) funds. In 2020, under the National Mission on Quantum Technologies and Applications Project 8,000 crore rupees (US$1.12 billion) are to be allocated for the commercial application of quantum computing over the next five years. 76 77

Japan sees quantum computing as a priority area for research and development. In 2020, the government allocated about 21.5 billion yen (US$207 million) in funding for quantum research in an attempt to make the nation a leading center for quantum research and development.78 The proposed road map envisions the establishment of at least five quantum innovation centers over the next five years, the production of a 100-qubit machine in about ten years, and construction of a fault-tolerant quantum computer by around 2039. Quantum technology is also financed through an additional R&D governmental program of 100 billion yen (US$964 million).79

The South Korean government has also joined the quantum race with an investment of 44.5 billion won (US$40.8 million) over the next five years, focusing on quantum hardware, architecture, algorithms, and software. Its goal is to develop a quantum computer with a minimum of 90 percent reliability by 2023.80

Established in 2007, Singapore’s Centre for Quantum Technologies (CQT) has invested over S$40 million (US$30 million) in quantum projects and published over 2,000 scientific papers.81 Along with other investments from grants and the national Quantum Engineering Programme, the total quantum expenditure over the past five years is estimated to have been around S$150 million (US$112 million).82

North America

The US has a long history of investing in quantum technologies, most of which is contributed by the Department of Energy, the National Security Agency, and the Intelligence Advanced Research Projects. In December 2018, the administration of then US president Donald Trump signed the National Quantum Initiative Act, a US$1.2 billion project aiming to boost the advancements in the quantum field. Along with that, a National Quantum Coordination Office has been established within the White House Office of Science and Technology Policy to coordinate the national efforts and create a multi-year strategic development plan.

The other country in the Americas with a strong public investment in quantum is Canada. The most notable project is the government-funded Waterloo Institute of Quantum Computing. In the past decade, Canadian investment in quantum research also reached the US$1 billion milestone83 through programs coordinated by the Natural Sciences and Engineering Research Council of Canada, the Canada Foundation for Innovation, the Canadian Institute for Advanced Research, and the Canada First Research Excellence Fund.

Australia

In Australia, the federal government supports quantum programs with approximately AU$130 million (US$185 million), in addition to state-level governmental funds. The main public institution that channels these funds is the Australian Research Council, which runs five major centers of excellence related to quantum technology: Engineered Quantum Science, Exciton Science, Future Low-Energy Electronics Technologies, Quantum Computation and Communication Technology, and the Centre for Gravitational Wave Astronomy.84

Private investment in quantum computing technology

Private investment in quantum computing technology

In most countries, the bulk of government investment goes toward research and development. At the same time, private entities help by setting up companies to advance the technology further, scale it up, and bring it into the commercialization phase. In the quantum field, one of the businesses' main goals is to identify and test various applications of quantum simulators, quantum computers, and quantum sensors and introduce them in different industries.

Even though some experts fear a potential “quantum winter”, in which the interest in quantum technology decreases significantly and the investment volume drops, the current situation suggests an ascending trajectory. In line with the volumes of government investment and the number of companies active in this field, various private funding initiatives registered a considerable increase in funds raised over the last decade.

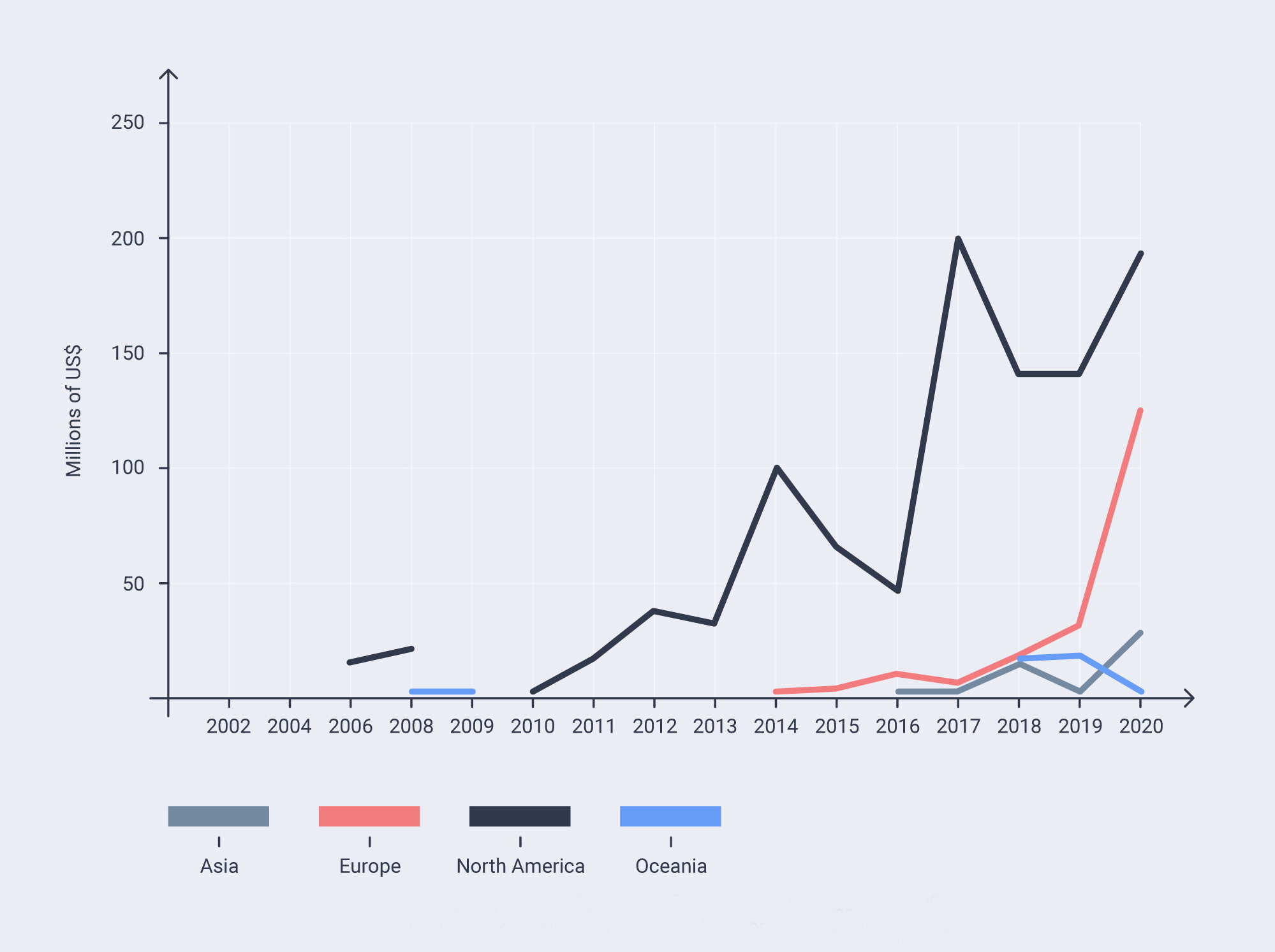

Google’s announcement in 2019 that it had attained quantum supremacy led to a spike in investment, especially in Europe, which apparently seized the opportunity to advance in the quantum race. Similar developments have been observed in Asia and North America. In terms of the amount of funding raised, North America has a clear leading role. However, although investment levels are lower in Asia, this region compensates for that shortfall with robust and sustained governmental spending.

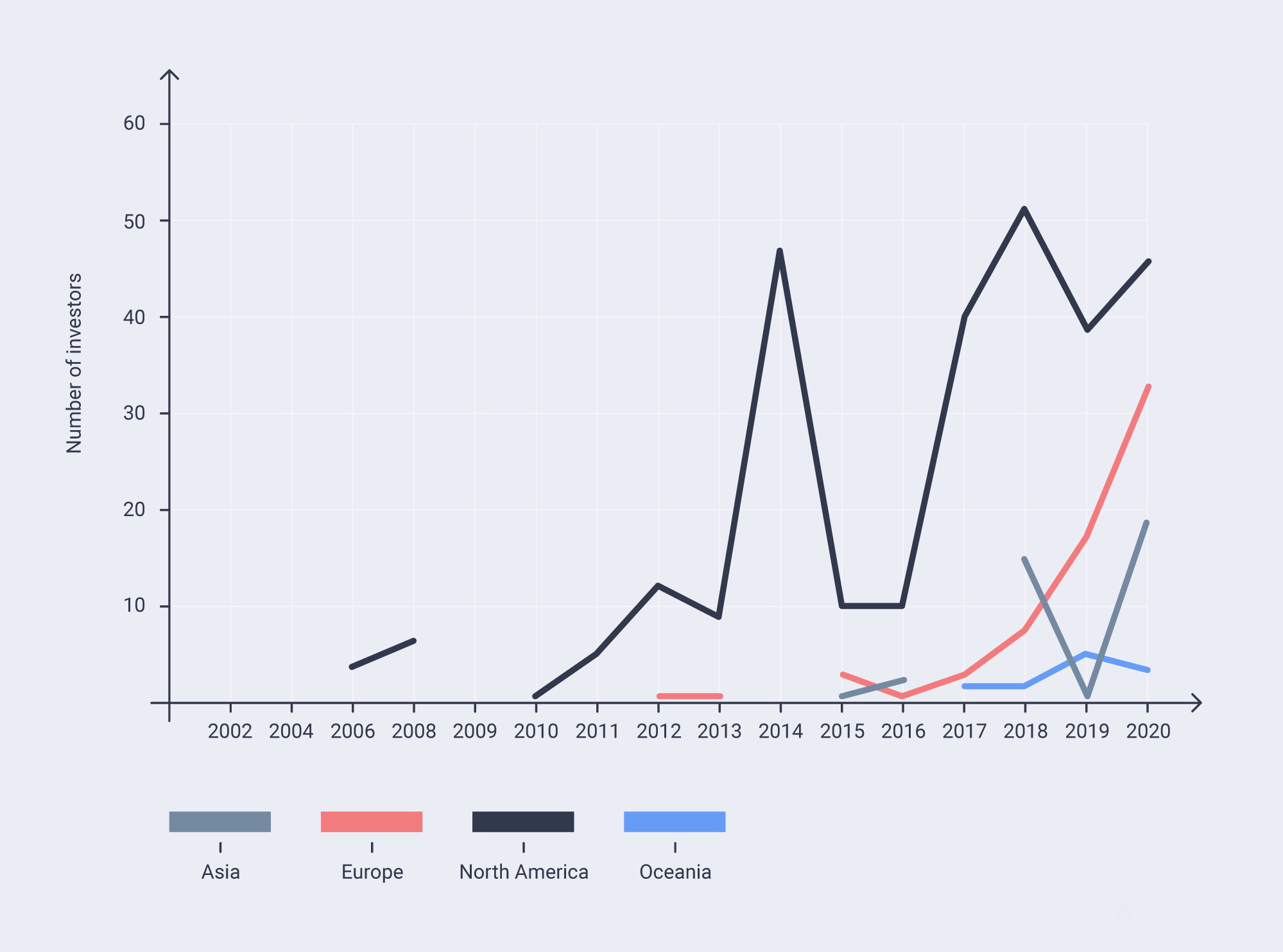

The number of investors is also on the rise, with more venture capital firms, business angels, hedge funds, and business incubators betting on the success of this technology. In all regions, the number of investors follows a similar trajectory as the volume of investment. This would seem to imply that the increase or decrease in investment was more or less determined by the number of investors entering or leaving the field, and not by a significant change in their contributions.

Many of the private investors in quantum computing have a strong focus on technology and innovation, whereas others are spinoffs of consumer companies that foster young talent.

Investment in quantum computing comes with a high diversification potential. Investments can be made in companies from various industries that could benefit from a potential breakthrough in quantum computing. At the same time, investing in the quantum computing companies themselves (either those building the hard- and software or those developing ways to use it) will most likely yield high returns on investment.

A comparative analysis developed by Alex Kiltz of Unternehmertum Venture Capital85 shows the difference in investment levels and number of closed deals in North America and Europe.

In Europe, investment in quantum computing companies has increased fairly steadily, and the number of closed deals grew constantly between 2012 and 2019. North America registered a relatively similar trajectory. However, the amounts invested in Europe are significantly lower compared to the level of equity funding in the US and Canada.

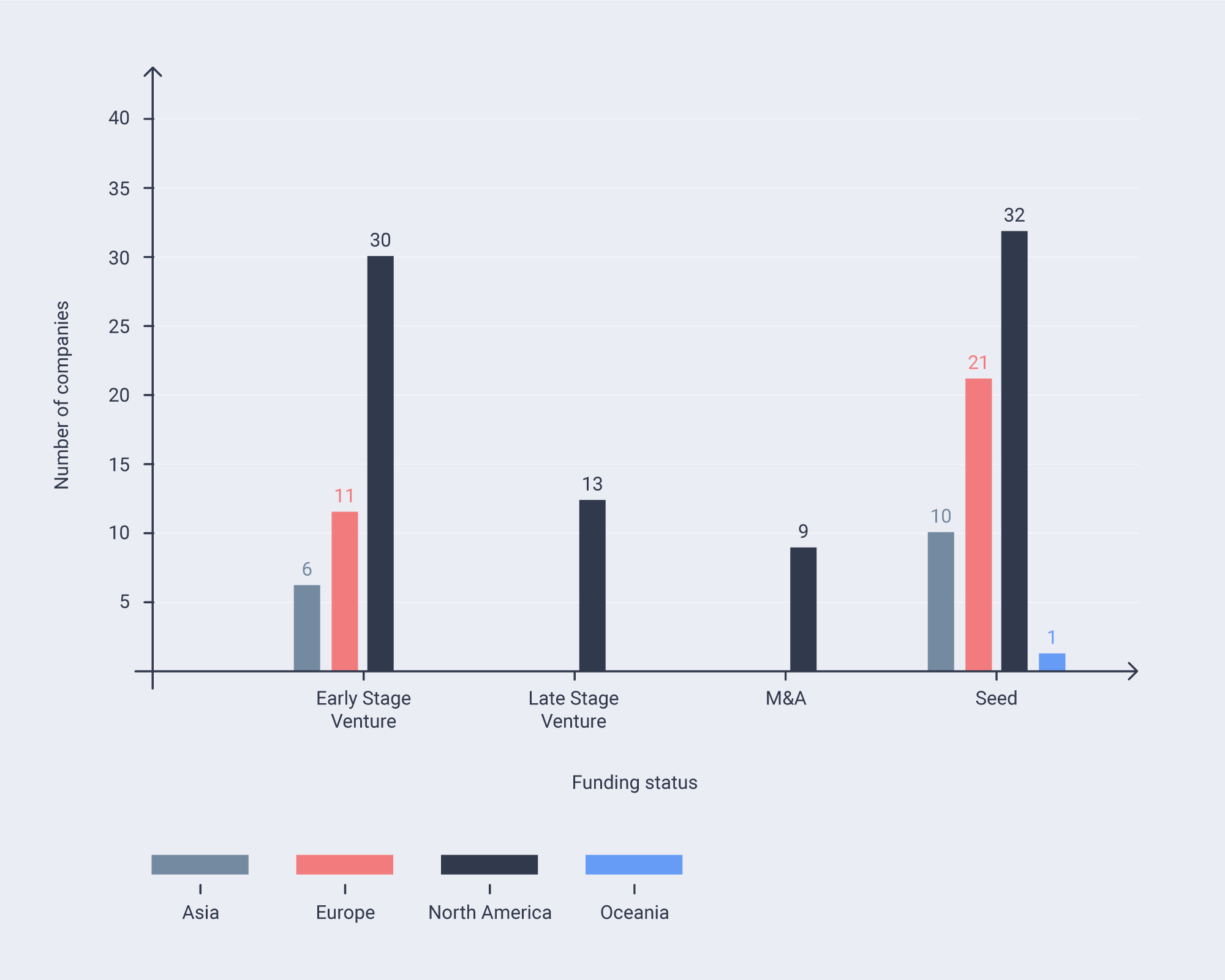

Similar findings are supported by an analysis of 202 funding rounds that took place between 2002 and 2020 in North America, Europe, Asia, and Oceania. North America is at the forefront in terms of total investment. This is likely due to the high interest in the quantum field in this region, but also to the fact that this region started to invest relatively soon in this technology and has maintained a sustained and continuous investment volume throughout.

Eight times more funds are privately invested in North America’s startup ecosystem than in the European landscape. The private investment in Asia is significantly lower, since the industry in this region is mostly controlled and financed by governmental projects.

Because North America became involved in quantum research at an early stage and stimulated the adoption of this technology within the industry, this region has the highest number of companies in an advanced funding stage. However, most businesses across all four regions are still in the first official equity funding stage (seed), meaning that they are still working on product development and on their market strategy. As a consequence, they often lack sufficient funds, which may be an impediment in acquiring all the equipment and technology necessary to produce significant advancements in the quantum field. In such cases, partnerships with universities and government-funded research centers are common, as are partnerships with larger and more established companies.

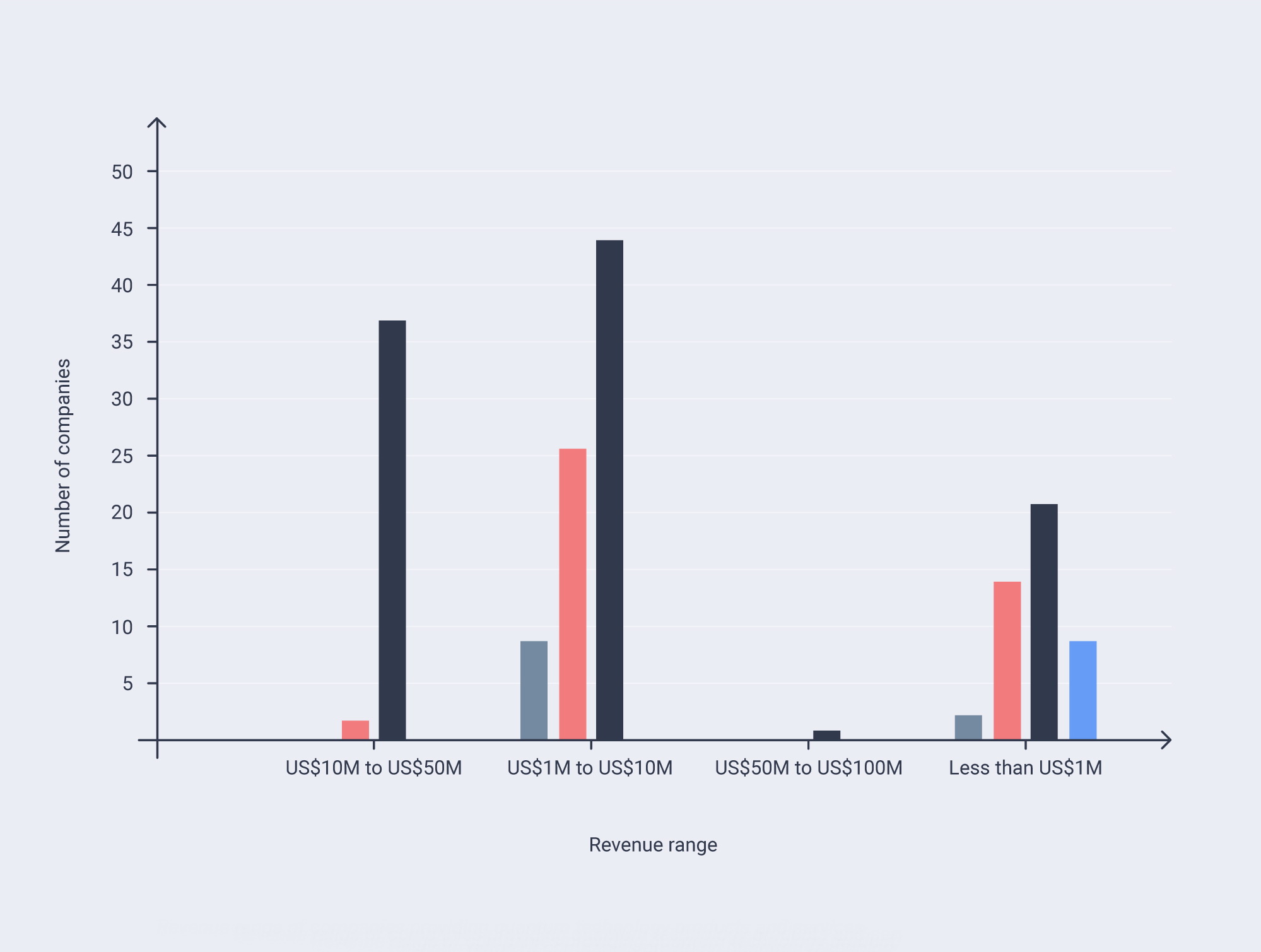

Because quantum technology is at an early stage of commercialization, a significant number of companies in all regions post less than US$1 million in revenue. Those companies that have managed to commercialize their products services are active in the B2B area providing cloud access to quantum devices, selling hardware components and equipment, or developing industry-centered applications.

Besides venture capital firms (e.g., Maverick Ventures, Rising Tide, etc.), accelerator programs (e.g., Creative Destruction Lab), and corporates (e.g., Honeywell) that have already invested in quantum startups, quantum computing shows promise for individual investors and business angels as well.

The majority of investors are located on the North American continent, while approximatively one third of them are in the Europe, Middle East, and Africa (EMEA) region. No relevant public data is available regarding individual investors in the Asia-Pacific region. The funding rounds in which they participated ranged from US$250,000 to US$25 million. Wealthier business angels have diversified portfolios with investments in different industries; however, almost 20 percent of them chose to invest only in a single quantum-oriented company. Rigetti and Strangeworks are the two companies that attracted the highest number of individual investors.

References

[69] Celia Merzbacher, “Global QC Market Projected to Grow to over $800 Million by 2024,” QED-C (blog), September 28, 2020, https://quantumconsortium.org/global-qc-market-projected-to-grow-to-over-800-million-by-2024/.

[70] “Quantum Technologies Flagship kicks off with first 20 projects,” Text, European Commission - European Commission (blog), accessed November 16, 2020, https://ec.europa.eu/commission/presscorner/detail/de/MEMO_18_6241.

[71] Peter Knight and Ian Walmsley, “UK National Quantum Technology Programme,” Quantum Science and Technology 4, no. 4 (October 29, 2019): 040502, https://doi.org/10.1088/2058-9565/ab4346.

[72] “Quantum Hegemony?,” accessed November 11, 2020, https://www.cnas.org/publications/reports/quantum-hegemony.

[73] “National Quantum Info Lab Construction Urged - Chinadaily.Com.Cn,” accessed November 19, 2020, https://www.chinadaily.com.cn/a/201903/11/WS5c85a605a3106c65c34edce6.html.

[74] Paul Smith-Goodson, “Quantum USA Vs. Quantum China: The World’s Most Important Technology Race,” Forbes, October 10, 2019, https://www.forbes.com/sites/moorinsights/2019/10/10/quantum-usa-vs-quantum-china-the-worlds-most-important-technology-race/.

[75] Mariana Iriarte, “Russia Invests $790M into Its Quantum Future,” HPCwire, January 6, 2020, https://www.hpcwire.com/2020/01/06/russia-invests-790m-into-its-quantum-future/.

[76] Ivan Mehta, “India Finally Commits to Quantum Computing, Promises $1.12B Investment,” The Next Web (blog), February 1, 2020, https://thenextweb.com/in/2020/02/01/india-finally-commits-to-quantum-computing-promises-1-12b-investment/.

[77] Economic Times Online, “Budget 2020: Govt Proposes Rs 8,000 Cr Boost for Quantum Tech,” The Economic Times, February 1, 2020, sec. Economy, https://economictimes.indiatimes.com/news/economy/policy/budget-2020-policy-to-build-data-centre-parks-across-country-soon/videoshow/73835708.cms.

[78] Yasuhiro Takeda, “What Are the Main Areas of Research in Japanese Quantum Computer R&D?,” Mitsubishi Research Institute 50th Anniversary Website (blog), accessed November 23, 2020, https://www.mri.co.jp/en/50th/columns/quantum/no04/.

[79] “Japan Plots 20-Year Race to Quantum Computers, Chasing US and China,” Nikkei Asia, accessed November 23, 2020, https://asia.nikkei.com/Business/Technology/Japan-plots-20-year-race-to-quantum-computers-chasing-US-and-China.

[80] “Korea Starts Five-Year Development Program for Quantum Computing Technology,” accessed November 23, 2020, https://k-erc.eu/korea-rd-research-trends-and-results/korea-starts-five-year-development-program-for-quantum-computing-technology/.

[81] National University of Singapore, “Shaping the Future of Quantum Technology,” NUS NEWS (blog), July 23, 2019, https://news.nus.edu.sg/shaping-the-future-of-quantum-technology/.

[82] Dimitris Angelakis, Rainer Dumke, and Christian Kurtsiefer, “Quantum Technologies in Singapore - Preparing for the Future.” (QuantumSG, October 2019), https://quantumsg.org/wp-content/uploads/2019/10/QuantumSG-%E2%80%93-preparing-for-the-future.pdf.

[83] Ben Sussman et al., “Quantum Canada,” Quantum Science and Technology 4, no. 2 (February 22, 2019), https://doi.org/10.1088/2058-9565/ab029d.

[84] TM Roberson and AG White, “Charting the Australian Quantum Landscape,” Quantum Science and Technology 4, no. 2 (February 22, 2019), https://doi.org/10.1088/2058-9565/ab02b4.

[85] Alex Kiltz, “The European Quantum Computing Startup Landscape,” Medium, October 13, 2020, https://medium.com/uvc-partners-news/the-european-quantum-computing-startup-landscape-a115ffe84ad8.