Our selection of 150 companies in the anti-aging business are based on individual company’s focus and core technology. The landscape evolves rapidly in this field. We found that the general trend of anti-aging start-ups is moving towards a faster life cycle. This trend is reflected in the founding, maturing, and exiting of the companies.

It is not always easy to differentiate a company that is focusing on aging itself from one that is focusing on the age-related diseases. We found that lists of anti-aging companies ranged from 68 in Jim Mellon’s book Juvenescence to a few hundred in the report of longevity.International .16,17. Our principle for selecting anti-aging companies is to make sure that the technology used by a company can be applied to the spectrum of age-related diseases.18 There is no surprise that the mechanisms behind therapeutics almost always are one of the nine hallmarks of aging.

The new start-ups

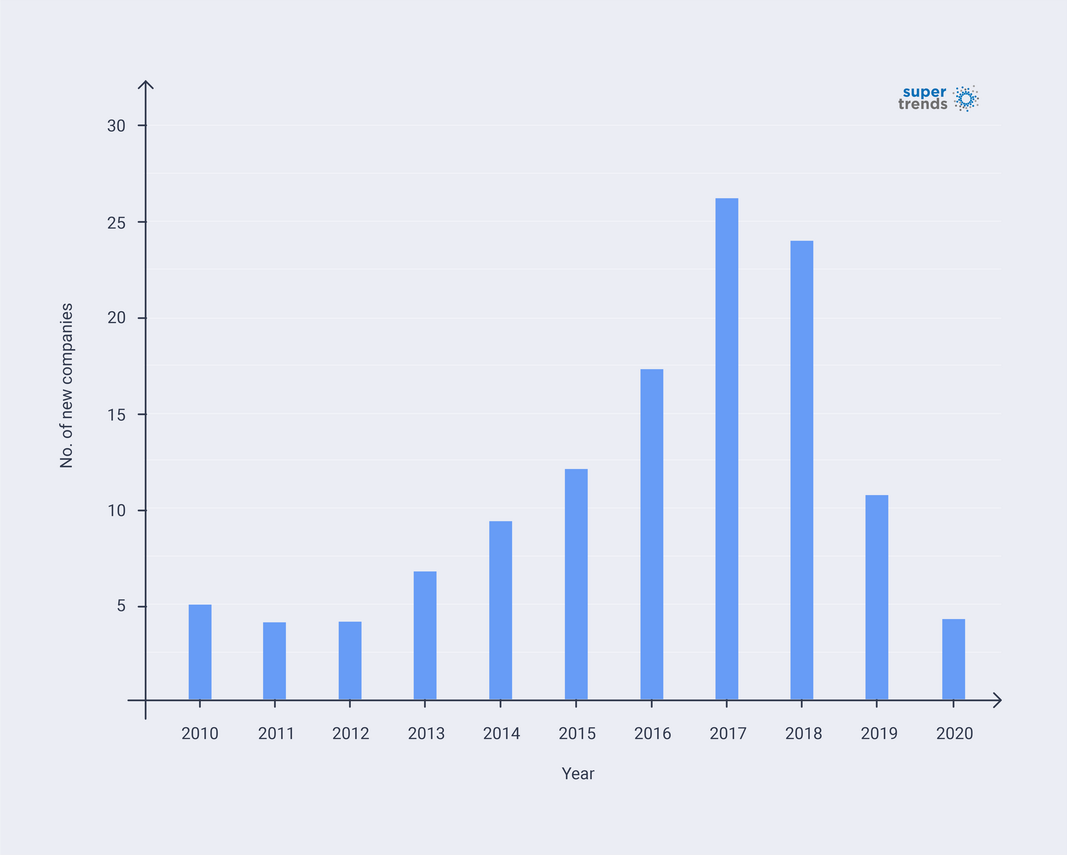

From 2014 to the start of the COVID pandemic, there has been a take-off in the number of new companies founded each year. The number of new start-ups each year increased from single digits to more than ten in 2015, and further increased to more than 20 in 2017 before dropping back to 11 in the year 2019. There could be many reasons for the drop of numbers in 2019, and especially in 2020. Due to the COVID pandemic, our world has been experiencing extreme uncertainties. Many medical and research resources were dedicated to combating the pandemic. The discussion of these reasons is beyond the scope of this document.

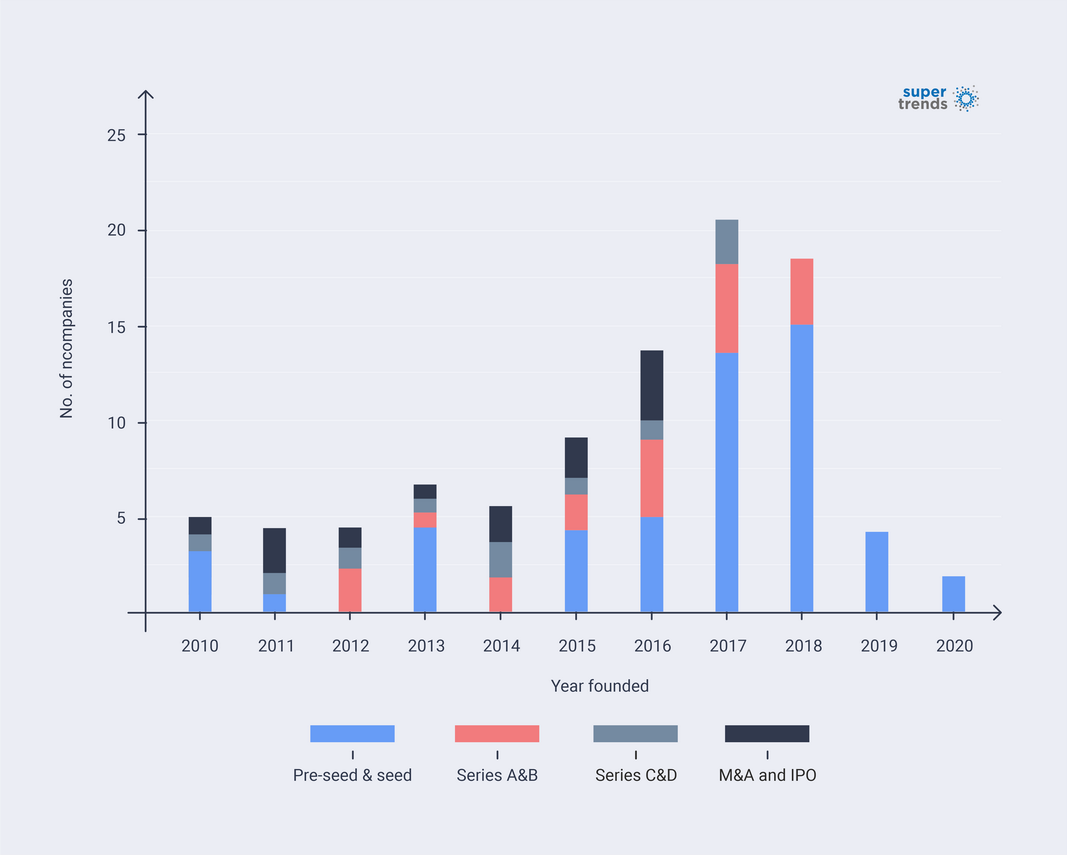

The maturing of start-ups

Based on data from both Crunchbase and PitchBook, we found when anti-aging companies opt for venture capital (VC) funding, the maturing starts to take place in about two years. By year five, more than 50% of the companies have either entered the VC series or exited.

For example, in April 2021, 18 out of the 28 anti-aging companies founded in 2018 are VC-backed. Among the 18 companies, 3 are in the series A & B round while 15 remain in the seed round. At the same time, 9 out of the 12 anti-aging companies founded in 2015 are VC-backed, with 2 in series A & B round, 1 in series C & D round, and 2 exits.

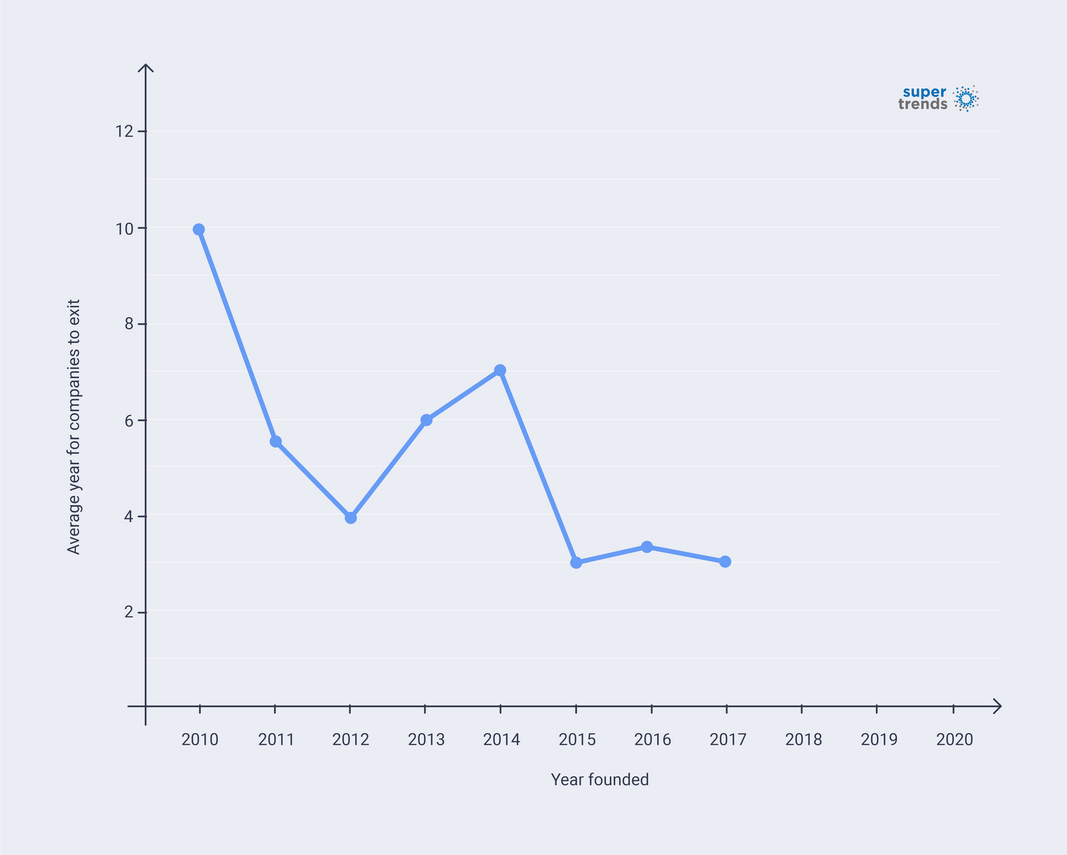

The exit of start-ups

The average year it took for an anti-aging company to exit, either by a merger and acquisition (M&A) or by an initial public offer (IPO), was 10 years for companies founded in 2010. This figure has been reduced to 3 years since 2015.

In general, the start-up ecosystem in the business of anti-aging medicine is healthy and growing fast. More and more new start-ups are entering this business each year, and companies also are growing and maturing more quickly. A good percentage of the start-ups were able to move into the next funding stages and eventually exit either through a merger or acquisition or an IPO.

Click to view the Supertrends anti-aging company database

References

16. Mellon J. and Chalabi A. Juvenescence. (Fruitful Publications, 2017), https://www.juvenescence-book.com/

17. Longevity.International. Longevity industry landscape overview 2018 Volume II: The business of longevity. 2018. https://www.longevity.international/longevity-industry-landscape-vol2

18. AgingBiotech.info. What counts as aging? Accessed Apri 30th, 2021, https://agingbiotech.info/about/what_counts_as_aging.html