The potential drawbacks of green hydrogen are related to its physical properties, which require special attention when retrofitting old hardware or building new assets for conveying and storing this gas, which is considerably lighter than natural gas. These considerations lead us to a discussion of the possible cost trajectory and associated storage and distribution infrastructure, and expectations as to when green hydrogen will become competitive. That will be determined by multiple factors, including competition between electromobility and fuel-cell vehicles and customer perceptions.

Drawbacks of H2

Drawbacks of H2

The primary drawback of hydrogen as an energy carrier is that is light, with very small molecules. This makes it hard to handle. It leaks easily from traditional pipes, vessels, and containers, and is hard to pump. Currently, it needs refrigeration to compress and takes up a lot of space if uncompressed. This necessitates special equipment and handling, especially during distribution and storage. The fact that it reacts corrosively with certain materials used for the manufacturing of gas pipelines means that pretreatment is necessary before conventional infrastructure can be used to transport it, and additional sealing is also often required, but the cost is significantly lower than constructing new pipelines. However, new pipelines will be needed, too.

New technologies for storing hydrogen in solids and organic oils and as other, hydrogen-containing gases such as ammonia are increasingly addressing these drawbacks, and as mass distribution models are implemented, one can safely expect many more such solutions to be developed. Green hydrogen is still expensive to generate, as are the required end-use devices and vehicles. Economies of scale should correct this drawback over time, and it can be overcome in the short term with subsidies.

Cost trajectory models

Cost trajectory models

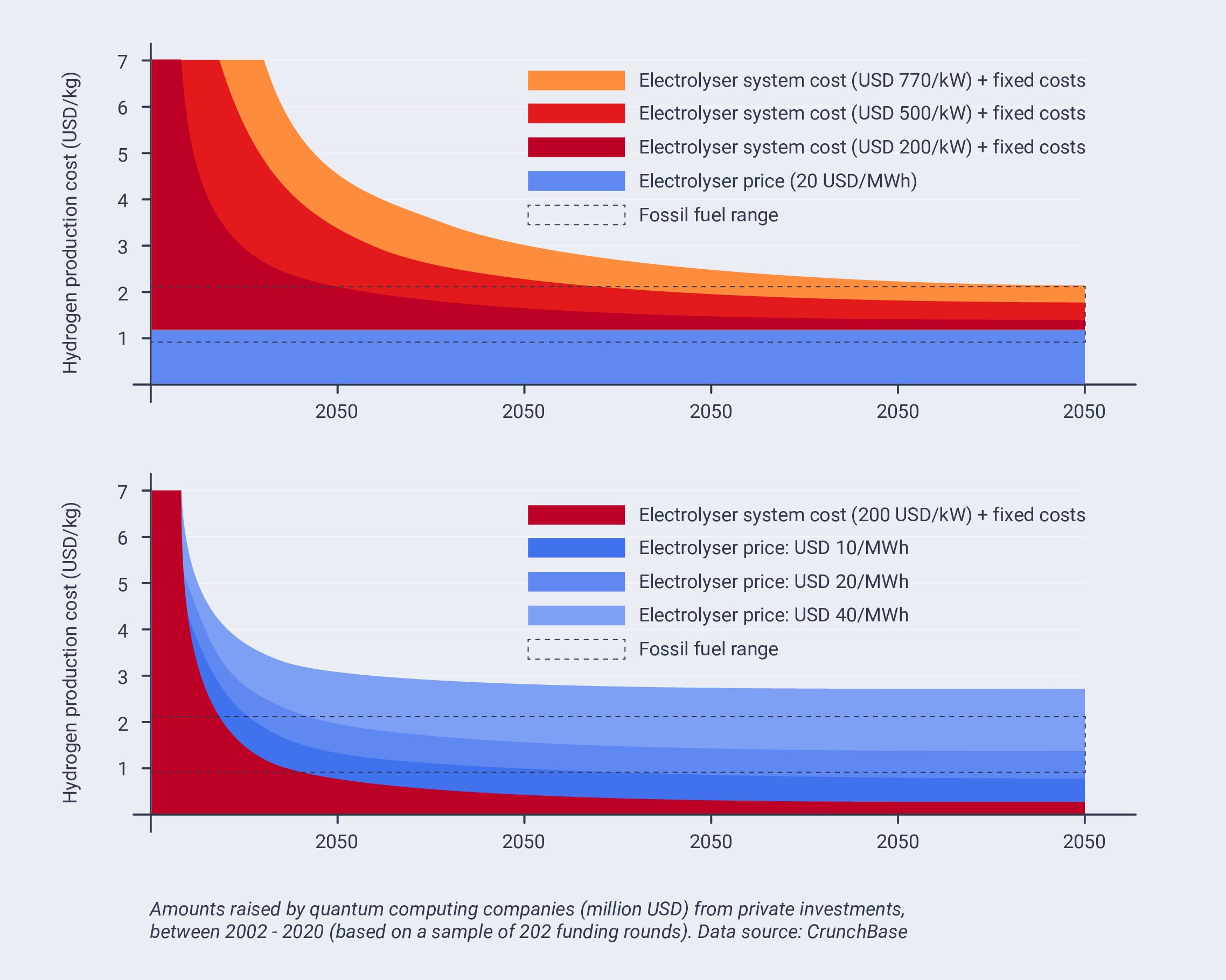

Before the massive EU commitment, analysts were suggesting that renewable hydrogen could be produced for US$0.8 to US$1.6/kg in most parts of the world before 2050. This is equivalent to gas priced at US$6-12/MMBtu, making it competitive with current natural gas prices in Brazil, China, India, Germany, and Scandinavia on an energy-equivalent basis.

When including the cost of storage and pipeline infrastructure, the delivered cost of renewable hydrogen in China, India, and Western Europe could fall to around US$2/kg (US$15/MMBtu) in 2030 and US$1/kg (US$7.4/MMBtu) in 2050.

With selective public development and pricing support, those sorts of figures could be reached much sooner, perhaps as early as 2035 if more countries create programs similar to the EU’s Hydrogen Roadmap.

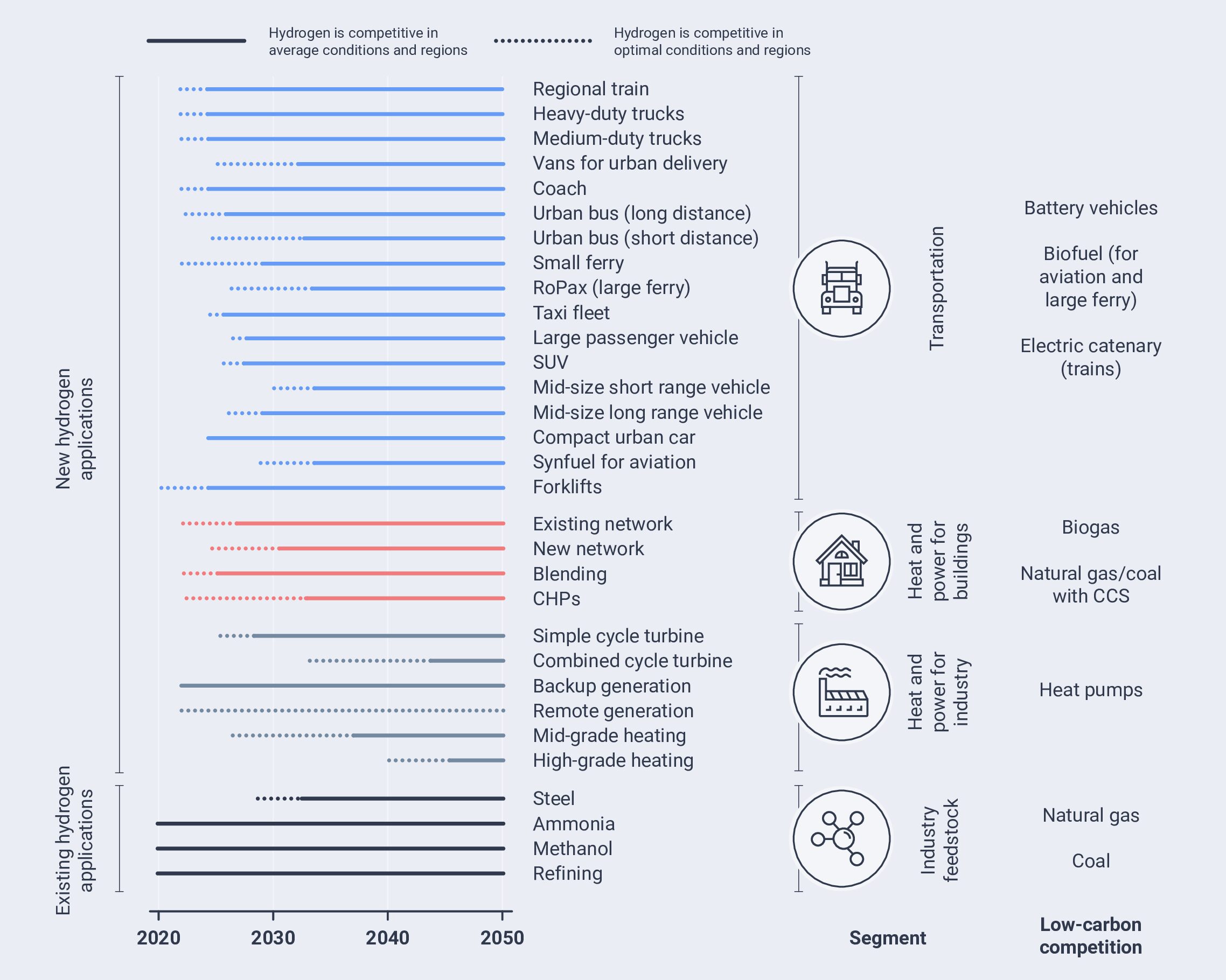

However, the question of when green hydrogen is likely to be competitive is a complex one. Not all segments of the economy will reach par with conventional energy sources at the same time; some perhaps never will do so universally, but only in certain locations and under specific sets of usage characteristics.

Compact urban cars will probably never be fully competitive, except where very low generation costs are possible, for example through strong and cheap renewable energy availability. Transportation, in general, should see parity from 2025 onwards in certain areas of application such as heavy-duty trains and trucks.

Heat and power for industry will take longer, only reaching parity universally beyond 2035, with a possible exception being backup generation capacity. But generally, given the massive investments and upscaling planned, the cost trajectory will be tending downwards, and the utility factor increasingly upwards.

Cost of distribution and storage infrastructure

Cost of distribution and storage infrastructure

Hydrogen filling stations represent a key part of the investment in new infrastructure for a hydrogen economy. They are required both by and for a hydrogen fleet, and as such, their development and implementation must lead the introduction of hydrogen and hydrogen-hybrid vehicles.

With the largest penetration likely to be into commercial fleets, and those fleets requiring local, regional, national, and international access to filling station infrastructure, the number of filling stations must grow commensurately. In the EU, the penetration into both sales and vehicles on-the-road is currently less than one percent, and this will likely remain true through 2025. However, with a rapid roll-out of hydrogen filling stations, a major usage barrier is removed. Studies by the European Commission predict that the percentage of hydrogen and hydrogen-hybrid vehicles on the roads could reach 4.2 percent in 2030, 11.3 percent in 2035, 21.3 percent in 2040, 33.8 percent in 2045, and 52.7 percent in 2050.

To facilitate this, around 1,500 filling stations will be required in Europe by 2025, at an investment point of €3.5 billion. By 2030, 3,700 stations will be needed, representing an investment of €8.2 billion, and by 2050, around 15,000 stations will be required, for a total investment of €27.5 billion.

At the same time, those filling stations will have to be supplied with enough hydrogen to sell. While in some cases, filling stations servicing industrial areas with other hydrogen consumers are geographically clustered, localized hydrogen generation could be fed using new or existing infrastructure over relatively short distances, which would be feasible without adding significantly to the cost of the hydrogen. In fact, any cost may well be offset if demand, and thus generation, is large enough for the economies of scale in the production process and the saving of shared storage to kick in.

Using conventional pipelines for hydrogen transportation over long distances, or localized gas distribution infrastructure for last-mile delivery, is typically possible with minor modifications, but massive amounts of new pipeline infrastructure will be required. Economies of scale also play a role here: The more hydrogen can be transported, the more the per-unit price of transport is reduced. At levels of 5 Gm3/year, transport costs reach €0.23 per kilogram, whereas the ability to transport 30 Gm3/year would see that cost reduced by half to around €0.125.

Gaseous trucking currently adds about US$1.00 to the cost of a kilogram of hydrogen transported. By 2030, increases in volume transported and better transportation technologies should see that reduced to about US$0.80. Liquid trucking is cheaper as transport in greater volumes become possible and necessary. Technical infrastructure and safety demands are higher, of course. Transporting hydrogen as a liquid only adds about US$0.40 to the price of a kilogram. This should fall to about US$0.20 by 2030.

In a new pipeline today, the distribution cost for a kilogram of hydrogen is about US$1.60, but better materials and more effective pumping technologies will bring this down to the range of US$0.40 by 2030.

In total, studies for Europe show that by 2030, investments in hydrogen storage and buffering infrastructure required to reach the goals set out by the EU’s Hydrogen Roadmap will reach €8.4 billion, with further costs of €10.6 billion resulting from the hydrogen distribution and retail sector.

Scaling up distribution channels and refueling stations is key for achieving cost reductions. When there is a network to leverage and high hydrogen volumes are to be conveyed, pipelines are the lowest-cost option. Energy consumption for the liquid and high-pressure routes is centralized; pipelines and low-pressure trucking require more higher-cost energy on-site.

In total, studies predict that Europe alone requires €65 billion in investment by 2030 to realize a growing hydrogen economy. As massive as that investment sounds, it is expected to create a market with up to €55 billion in annual sales.

Lobbying from legacy industries

Lobbying from legacy industries

Hydrogen in general (rather than green hydrogen in particular) has been actively lobbied for quite strongly by the fossil fuel industry. The main reason for this apparent support is the perception that hydrogen can offer a controlled transition to future technologies while still making significant use of available natural gas reserves. As such, for example, the hydrogen lobby in Europe that pushed for the EU Hydrogen Roadmap is largely made up of fossil gas companies. They have spent a conservatively estimated €60 million on influencing policymaking in Brussels annually, according to a study by Corporate Europe Observatory, Food and Water Action Europe, and Re: Common. They met with European Commissioners 163 times in the period December 2019 to September 2020, compared to just 37 such meetings with NGOs. The focus is, of course, on resurrecting carbon storage and use within the framework of hydrogen production in order to be able to participate in the environmental goals of the EU in terms of a hydrogen economy.

How effective is this lobbying in reality? There are two schools of thought on this. The first states that the massive investment that the conventional gas industry can bring to bear will stifle the growth of truly green hydrogen. The other argues that the growth in hydrogen generation, distribution, and storage infrastructure, the steadily decreasing cost of renewables, the additional cost and technical challenges associated with carbon storage, and the wider preference for green hydrogen over other varieties will significantly lessen the potential negative impact.

The lobbying landscape in other countries is similar, with a similar underlying logic driven by the opportunity to participate as fossil gas companies in the hydrogen transition. Even conventional oil- and coal-based electricity generators are in on the act – as are nuclear power plant owners, who tend to state that they are in a position to generate green hydrogen, as their plants emit only very small amounts of CO2.

Potential competition between fuel cell vehicles and electric cars

Potential competition between fuel cell vehicles and electric cars

As discussed elsewhere, the preferred next-generation powertrain for vehicles and certain vehicle types is beginning to crystallize. The vehicle manufacturing industry has thrown its weight behind electric battery-powered vehicles for small to medium consumer vehicles, and this is increasingly true for larger vehicles such as sport-utility vehicles (SUVs) also.

In the consumer space, vehicles are not used as heavily as in other areas, and electric batteries can carry the load, despite issues of weight and slow charging times. Even smaller fleet vehicles may qualify, although it is often good for larger fleets to unify their fuel needs, reducing costs that are incurred today by having a variety of fuels in use. In the EU, it is expected that in the fleet environment, only 14 percent of small cars and perhaps 28 percent of larger cars on the road by 2050 will be hydrogen fuel cell vehicles.

Vehicles that see heavy use, especially in commercial fleets – such as taxis, vans, light commercial vehicles (LCVs), buses, and trucks – should all see significantly larger shares in their particular segments. Taxis will likely be the most successful, with an expected 57 percent share, while buses are expected to reach around 30 percent and trucks 21 percent. However, from a sales perspective, taxis, vans/LCVs, and buses will make up almost half of all sales to fleets by 2050, trend rising, which means that their share of vehicles on the road with hydrogen-driven fuel-cell powertrains will still increase.

Consumer perceptions and concerns

Consumer perceptions and concerns

Recent surveys show that the main safety concerns of consumers relate to a lack of knowledge surrounding the environmental impact of green hydrogen production and use, and the low visibility of hydrogen use in vehicles. Perhaps less prevalent are concerns over price (“renewable” or “green” still being associated with “expensive” and “rare”) and the need for new vehicles and heating/cooling equipment as part of a switch to a hydrogen economy.

Safety concerns are most prevalent in the transport and home heating areas, where a perceived direct interaction with a volatile gas is likeliest to occur. This includes the safety of the refilling process in vehicles, as well as the likelihood of fires occurring while travelling. The home heating risk perception is likely to be less prevalent where gas heating is currently in use, but no data supporting this could be found. A gradual transition, with an increasingly larger percentage of hydrogen mixed into the gas feeding homes for heating, could also provide for a “soft” transition that also takes consumer trust issues into account.

A comparative study of consumer opinions regarding filling stations and the willingness to have one “nearby” showed only 25 percent of UK consumers reacting positively, compared to 52 percent in Japan. This may be due to longer exposure to hydrogen technologies in Japan, but data in support of this is also lacking. In Japan, 64 percent of respondents were positively disposed towards the introduction of fuel cell buses in their neighborhoods, with 32 percent unsure.

No recent evidence is available for how customers will respond to the prospect of a 100 percent hydrogen conversion and its possible effect on cooking and heating. Leeds Beckett University is working on an updated study for the UK, with initial results showing that 68 percent of the population is generally indifferent or undecided about a hydrogen conversion, implying that a great deal of targeted consumer information will be required to correct the imbalance.

Interestingly, among the executives driving the creation of new vehicles for consumers, opinions are clear: According to a 2018 Global Automotive Executive Survey, 78 percent of the 1,000 executives interviewed felt that fuel cell hydrogen vehicles were the future, with a further 62 percent stating their impression that battery-electric cars will fail eventually, due largely to issues related to infrastructure and slow charging time.