This chapter lays out the value chain involved in the production and use of green hydrogen. It examines the modalities, challenges and potentials of each element of that value chain, and introduces a number of companies active in each.

Overview

Overview

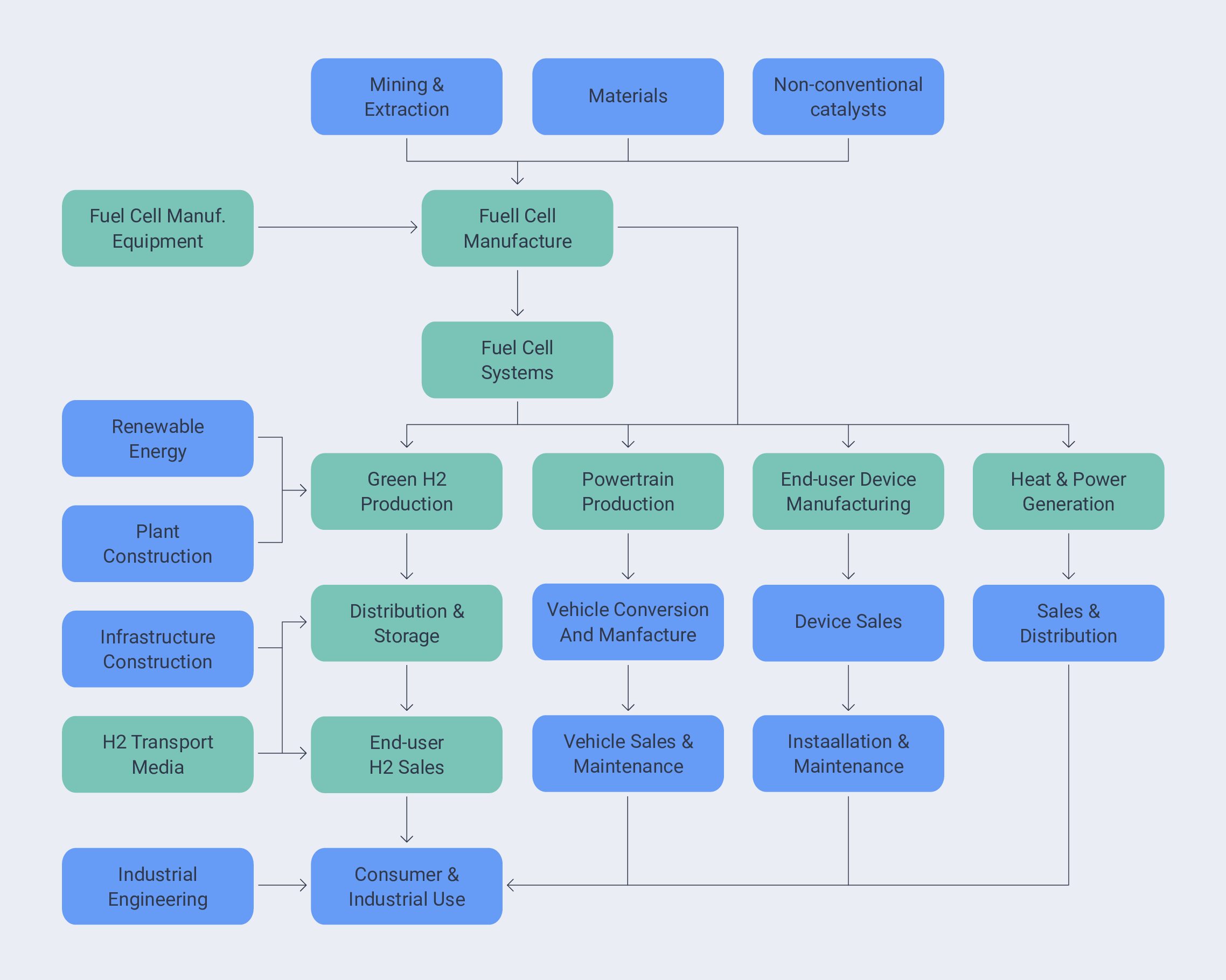

The value chain in green hydrogen is multifaceted and less linear than in some other markets. Each element of that value chain can be characterized as either a core element or a peripheral contributing element (Fig. 1).

Elements shown in green can be considered key elements of the value chain, whereas blue elements are somewhat more peripheral. While less linear, concepts such as “upstream” and “downstream” still very much apply, as indicated here by the direction of flow of the connecting arrows.

In this chapter, we will examine each element of the value chain in terms of a number of key characteristics. For key elements, they include:

- Geographic/Regional Specificity

- Technology/Service Model

- Companies with Controlling Interests

- Companies Leading Innovation

- Main Investors and Recipients of Funding

- Existing Trial Projects

Peripheral elements will be examined primarily in terms of the expected impact of significant growth in the green hydrogen field, example actors, and potential risks. The order will be roughly top to bottom and left to right.

Mining & Extraction (Peripheral)

Mining & Extraction (Peripheral)

Platinum and ruthenium play a large role in fuel cell production. Platinum is the catalyst that converts hydrogen and oxygen to heat, water, and electricity. Palladium will likely also play a role in fuel cells, but it is unknown as yet how significant that will be.

Platinum group metal (PGM) reserves are mainly distributed as follows:

| Country | Reserves (kg) |

|---|---|

| United States | 900 000 |

| Canada | 310 000 |

| Russia | 1 100 000 |

| South Africa | 63 000 000 |

| Other countries | 800 000 |

| World total (rounded) | 66 000 000 |

Anglo American Platinum (Amplats), Impala Platinum (Implats), and Lonmin are three major producers of platinum group metals in South Africa, which dominates reserves and extraction. Stillwater Mining of Montana, US produce platinum group metals in significant quantities, and significant quantities of PGMs are produced as co-products by Norilsk Nickel of Russia. Smaller (but still significant) quantities of PGMs are produced by Falconbridge and Inco of Canada.

Demand for PGMs is expected to increase significantly. Part of that demand will be met through recycling, but it seems likely that extraction and refining will increase in South Africa and elsewhere.

It should be noted that research is being done on using non-precious metals as catalysts – see the section on Non-conventional Catalysts below – which could reduce direct extraction demand in the middle term.

Materials (Peripheral)

Fuel cells require a number of key materials, including catalysts and membranes. As fuel cell manufacturing increases, demand for these materials will increase also.

Companies creating catalysts and membranes for the fuel cell manufacturing industry include Umicore, MeliCon GmbH (offering Gas diffusion layer (GDL) and Porous Transport Layer (PTL) materials), SGL Carbon GmbH (including separator plate foils), Agfa-Gevaert NV (including high-efficiency electrolysis membranes), Chemours International Operations SARL, and FUMATECH BWT GmbH.

Materials treatment technology suppliers – including brazing, coating, and sputtering – will also profit as fuel cell production increases. Companies like Aalberts Surface Technologies GmbH (brazing) and Hauzer (highly resistant coatings) are active in this area. Coatings are likely to be an explosive market, and Hauzer is well positioned and highly experienced in this area.

Non-conventional Catalysts (Peripheral)

Research is underway to undercut the need for directly applying extracted precious metals to the creation of catalysts for fuel cells. One solution is to use common metals instead, and work done at the Hydrogen and Fuel Cell Materials group in Argonne National Laboratory’s Chemical Sciences and Engineering (CSE) division uses the pyrolysis of iron, nitrogen, and carbon to create suitable catalysts.

At the University of Birmingham, research is being conducted into using platinum and palladium bio-synthesized nanoparticles as sustainable fuel cell catalysts.

Scientists at Guizhou University, China are researching the use of dendritic defect-rich palladium–copper–cobalt nano-alloys as robust multifunctional non-platinum electrocatalysts for fuel cells.

Once they have matured and been commercialized, these technologies could prove disruptive to extracted platinum demand in the growing fuel cell manufacturing market and offer extremely interesting investment opportunities.

Fuel Cell Manufacturing Equipment (Key)

In a development reminiscent of the heyday of the photovoltaic panel manufacturing industry, the design, production, and sale of the equipment required to manufacture complex technology products is proving far more resistant to cost pressures than the manufacturing processes themselves. These cost pressures tend to cause manufacturing to shift from high-cost to low-cost countries, causing disruption to companies and investors alike.

The construction of the manufacturing equipment tends to remain in countries with exacting machine-building engineering and craft skills, and companies in this sector are less likely to relocate. This brings with it a certain stability that is particularly useful in a lucrative and rapidly growing market. Europe, Japan, and the US (as well as, increasingly, South Korea) tend to benefit from this effect.

Interesting players in this market include Toray Engineering (Japan, manufacturing), Greenlight Innovation (US, testing), ASYS Group (Germany, manufacturing), VINATech (South Korea, membrane electrode assembly), and Sono-Tek (US, coating equipment).

Fuel Cell Manufacture (Key)

At the heart of the hydrogen revolution is the actual manufacture of the fuel cells themselves. In this rapidly growing and highly innovative segment, significant competitive pressures arise due to upscaling of production, extension of lifetimes, and price reduction. Good financing, solid technologies, good market access, and above-average engineering expertise are needed to remain competitive here.

The segment is currently still strongly based on own R&D and engineering, and thus bound to high-tech regions, but as fuel cells increasingly become standardized and more of a mass-market product, the ability to purchase whole production lines will see the manufacturing sector spread elsewhere. Cost pressures may impact the geographic distribution of fuel cell production at that time.

Companies active in this area include ElringKlinger AG (Germany, automotive), SOLIDpower (Germany, manufacturing for use in own end-user devices after acquiring staff and assets of Ceramic Fuel Cells), Robert Bosch GmbH (Germany, automotive), Powercell Sweden (Sweden, general purpose and drivetrains), Horizon Fuel Cell Technologies ( South Korea, transport and automotive), Intelligent Energy (UK, transport and drones), Toshiba (Japan, industrial, utility and automotive), Ceres Power (UK, low-cost, high-volume multi-fuel cells), Mitsubishi Heavy Industries (Japan, manufacturing for own power supply systems), Elcogen AS (Estonia, cells and stacks), cellcentric (Germany, automotive) and thyssenkrupp System Engineering (Germany, automotive, industrial, and submarines).

An interesting startup focusing on fuel cells for aviation use is HyPoint:

HyPoint

Aerospace, Air Transportation, Clean Energy, Drones, Electric Vehicle, Fuel Cell

Location: Menlo Park, California, United States

Products & Services: The next-generation hydrogen fuel cell for the aerospace industry and air transportation market.

Target Market: Aircraft manufacturers and manufacturers of powertrains for aircraft.

Perceived Risks & Opportunities: While there is pressure on the aviation market to decarbonize, the concept of fuel cells powering aircraft is still new and will gain acceptance only with proof of function, acceptable pricing, and consumer education. The need to create additional, new refueling infrastructure at airports may also slow uptake. However, the rapid refueling and comparative weight advantage compared to battery-electric powertrains are positive factors that make such systems attractive.

Main Competitors: Suppliers of conventional powertrains for aircraft, and a small group of companies working on green (also biofuel-based) solutions.

Contact

Current Investors: Alchemist Accelerator, Dmitry Shurygin

Fuel Cell Systems (Key)

One key activity in the green hydrogen value chain is the business of integrating fuel cells and their surrounding hardware into purposeful stand-alone units that can fulfil the intent of either users or end-user appliance makers and play a specific role in utilizing green hydrogen for heat and power generation.

Many companies active in this segment also make their own fuel cells for their own use, and construct the final systems based on those. In many cases, where the systems are stand-alone and for direct use, they tend to provide a small set of heat and power functions.

Backup or uninterruptible power for key applications such as health, security, and information technology is a very interesting market for fuel cell systems, especially with the increasing need to secure such functions against weather phenomena, seismic activity, and civil unrest. Companies who produce systems in this area include GenCell, AFC Energy, PowerUp Energy Technologies, and Doosan Fuel Cell.

Nuvera Fuel Cells, Inc. builds automotive fuel cell systems aimed at slotting into automotive powertrains built by third parties.

Ballard Power is a major player in this segment. They cover most applications, from backup power through systems for powertrains and marine energy plants. The company also offers several other products and services, including product development, engineering, and testing support. They have key partnerships with a number of automotive and energy provision partners and are well positioned to become a major force in the industry.

Interesting startups in this segment include Bloom Energy, Enapter, and PowerUp Energy Technologies.

Bloom Energy

CleanTech Energy, Fuel Cell, Oil and Gas, Wind Energy

Sunnyvale, California, United States

Products & Services

On-site power generation systems that can use a wide variety of inputs to generate electricity. Portfolio features a comprehensive line of large-scale fuel-cell solutions with local storage, as well as the ability to feed electricity into the grid if required by utilities for grid support.

Target Market

Companies and institutions that require uninterrupted power for their services and facilities, such as hospitals and emergency services, and would prefer that power to be clean and environmentally friendly. Geographically, their initial market is the US.

Perceived Risks & Opportunities

In a market dominated by conventional fossil-fuel-based uninterruptible power supplies, Bloom must also compete on price. This is slightly offset by the green nature of the energy provided, but will remain an important factor impeding growth. They are well positioned to supply both uninterrupted heat and power to clients where required, using fuel-cell-based co-generation, which would increase efficiency and reduce cost.

Main Competitors

Suppliers of natural gas-based on-site power generation infrastructure, such as Uniper and MTU Onsite Energy.

Contact

Current Investors

Goldman Sachs

Alumni Ventures Group

Kleiner Perkins

Credit Suisse

New Enterprise Associates

Other investors active in this segment include Zhongshan Broad-Ocean Motor, Weichai Power, Anglo American Platinum, the Canadian government, Chrysalix Venture Capital, VantagePoint Capital Partners, GrowthWorks Capital, Ventures West, and Arete Corporation.

Renewable Energy (Peripheral)

Renewable Energy (Peripheral)

While the large renewable energy sector is regarded as peripheral to the core green hydrogen value chain, it remains an important component of same and impacts it directly and indirectly in many ways. Success in the growth of the various renewable energy technologies and the significant reduction in the price of renewable heat and power generated by them increasingly makes green hydrogen viable, and it makes sense to consider integrating, co-locating, and coordinating the two elements.

Although renewable energy resources are not distributed homogeneously across the globe, the likelihood of finding one or more useful resources almost anywhere is pretty high. This makes it a key player in achieving clean energy production and energy independence almost anywhere. In turn, this means that a degree of green hydrogen generation should be possible in most places.

However, the size and accessibility of the resource are important factors. Locations with high resources, low land costs, good interconnectivity, and solid grid management are more likely to see renewable energy blossom, and thus also offer suitable conditions for making green hydrogen viable.

Offshore wind power currently provides the lowest and most suitable power for large-scale green hydrogen generation. It is possible to locate large-scale generation facilities near the landing point of offshore power cables, giving access to both large amounts of renewable energy and a good water resource to use in the generation process. Offshore salt caverns, where available, could provide relatively cheap hydrogen storage.

As such areas often lie outside of major population centers, large-scale storage and transshipment facilities could also be integrated, creating efficient and cost-effective green hydrogen hubs. While the final cost of hydrogen generated in this fashion still lies around €5.10/kg, and is expected to decline to around €3.70/kg as wind energy costs continue its downward trend, it still needs to compete with grey hydrogen at €1-1.50/kg.

However this widely accepted analysis omits the necessary internalization of external costs, as well as the economic advantage of avoiding situations where the energy generated by wind farms cannot be utilized because of grid overloads or demand reductions. It also ignores the massive pressure developing politically and the increasing support from the legislative side – also financially and in the form of tax breaks – due to the need for universal decarbonization.

For this reason, major players such as Shell, Equinor, RWE, and TechnipFMC are investing heavily in this technology at this early stage.

In areas with strong solar resources, energy prices are also low and falling, and especially in hot, dry, sparsely populated areas of coastline in places like Australia and North Africa, the conditions are in place to facilitate a similar model as proposed for wind above.

As fuel cell prices fall and efficiency levels rise, it is expected that distributed renewable energy generation at a smaller scale can be combined with hydrogen generation technologies and storage to facilitate extending a green hydrogen infrastructure to remote areas and smaller habitations. In time, it may well come to represent a leapfrog technology for new and rural electrification, in much the same way as the cellphone – initially regarded as too expensive – is providing telephony services where none existed before.

Plant Construction (Peripheral)

Plant Construction (Peripheral)

The construction of large-scale hydrogen generation plants requires experience with plant construction in general and hydrogen plant construction in particular.

While there are numerous plant construction companies around the world, South Korea has emerged as a reliable and knowledgeable partner in constructing plants of all types around the world. In this sophisticated and stable financial market, long-term stable investments in the plant construction and engineering sector will benefit from increased global demand for hydrogen manufacturing infrastructure.

A selection of larger and smaller players in that market includes Sunjin Engineering, KUMHO E&C, Daelim Industrial Company, Daewoo Engineering & Construction Co., Ltd., Dohwa Consulting Engineers Co., Ltd., Doosan Heavy Industries & Construction Co., Ltd., GS Engineering & Construction Co., Ltd., and Halla Energy & Environment.

Green H2 Production (Key)

The production of green hydrogen consists of two key components – manufacture of the equipment required to do so, and producing the gas itself. The former is perhaps the more interesting, as it enables many other players to undertake gas production.

The large chemical corporations producing hydrogen today will be the first to generate large amounts of green hydrogen centrally in the future, but using the equipment provided by hardware manufacturers, smaller companies and utilities will also be enabled to do so.

Among the companies that make medium- to large-scale green hydrogen production units are Enapter, Areva H2Gen, ITM Power, Green Hydrogen Systems, ACWA Power, and Nel Hydrogen.

Large-scale integrated hydrogen production storage and utilization through technologies like power-to-X and X-to-power are offered by some of the larger players. Siemens Energy and Air Liquide will develop a large scale electrolyzer partnership for sustainable hydrogen production in Normandy with a capacity of 200 MW – a significant exercise in scaling using standard modules.

Large-scale green hydrogen generation through the creation of co-located renewable energy generation capacity and power-to-X infrastructure holds great potential for efficient, low-price green hydrogen generation. One example is the planned Asian Renewable Energy Hub (AREH), being developed by CWP Renewables and a consortium of partners. Situated on more than 6,500 square kilometers in the remote Pilbara region of Western Australia, and with an estimated capital cost of US$36 billion, the 26 GW hybrid wind and solar power plant for hydrogen production will be the world’s biggest energy project, and the largest single infrastructure project ever developed in Australia.

Another example ties offshore wind energy to green hydrogen generation – perhaps the cheapest way of generating green hydrogen today. Ørsted will develop one of the world’s largest renewable hydrogen plants to be linked to industrial demand in the Netherlands and Belgium. It will combine the construction of new offshore wind farms off the coast of the Netherlands with green hydrogen generation from that wind energy to fulfil the requirements of heavy industry in the region. The major industrial companies in the region – ArcelorMittal, Yara, Dow Benelux, and Zeeland Refinery – support the development of the required regional infrastructure to enable sustainably-produced steel, ammonia, ethylene, and fuels in the future, helping the Netherlands and Belgium to accelerate their carbon reductions towards 2030 and beyond.

Investors in the segment include EASME – EU Executive Agency for SMEs, Drashta Ventures, The FSE Group, The Yield Lab, Cottonwood Technology Fund, Sun Mountain Capital, and others

Powertrain Production (Key)

Powertrain Production (Key)

Powertrains and integrated chassis are the enablers of the hydrogen fleets of tomorrow. As such, the companies developing those drive change will contribute greatly to making it possible for various mobile applications to be brought to market.

While some aspects of this segment appear fairly conventional – such as drivetrains for buses and trucks – a number of companies are focusing on drivetrains that will help decarbonize harder-to-reach transport sectors, such as air travel and ocean transport.

A number of full-spectrum fuel cell solution providers such as Ballard are developing fuel cells, support systems, and powertrains for seafaring vessels that provide propulsion, auxiliary power, or both. Vessels in harbor are often required to switch off diesel engines, and need to draw power from barges or shoreside supplies. Fuel cells also offer solutions in this area.

Aviation, where the fuel cell powertrain needs to provide a good weight-to-power ratio, brings with it its own set of challenges. Companies such as Honeywell Aerospace are developing fuel cell systems to power aircraft of various types. Unmanned aerial systems especially are likely to benefit first from such systems. Currently, many of these vehicles use battery-powered electrical engines that take a long time to reload. Fuel cell systems offer rapid refueling and far quicker turnaround times.

In the ground-based mobility sector, companies such as Cummins and others are focused on developing scalable powertrains that can handle applications from forklifts for materials handling to heavy machinery, mining applications, long-haul vehicles, and trams and railways.

Supportive design, engineering, and testing service providers will also profit from a rapidly growing market in this segment. Companies such as FCP FUEL CELL POWERTRAIN GMBH that offer solid design and engineering services as well as testing services and facilities will help speed up the development of new powertrains based on fuel cell technology.

Because powertrains in mobile applications based on fuel cells need fuel, companies that can provide the advanced fuel storage tanks for such applications will also profit. The differentiated high-capacity fuel tanks systems developed by Quantum Fuel Systems, for example, allow powertrain developers to select placement and required capacity for a wide selection of vehicle types, from cars, trucks, and buses to aerospace solutions.

Collaboration across providers of engines, powertrains, and vehicles is also increasingly common, to the benefit of all partners. A recent agreement between FPT Industrial, IVECO, and Snam exemplifies this type of collaboration.

Classic engineering companies such as Bosch Engineering are also drawn to hydrogen powertrains. Bosch offers both a fully integrated powertrain as well as individual components for use by third parties.

And of course, conventional vehicle manufacturers themselves are also reacting to the pressure to decarbonize the mobility and transport sector and are pursuing the development of fuel cell powertrains. Daimler Truck AG and the Volvo Group recently created cellcentric, a partnership to create a powertrain for use by both partners.

An interesting startup in this segment, ZeroAvia, focuses on drivetrains for aviation:

ZeroAvia

Aerospace, Air Transportation, CleanTech

Hollister, California, United States

Products & Services

ZeroAvia is building the world's first practical zero-emission aviation powertrain, based on hydrogen fuel cells.

Target Market

Hydrogen-electric powertrain for small aircraft.

Perceived Risks & Opportunities

In a market dominated by powertrains that use conventional fossil-fuels, Bloom must also compete on price. This is slightly offset by the environmentally sound nature of the solution, but will remain an important factor impeding growth. Due to scalability issues, initial target airframes are limited to 10-20 seats. However, even this constitutes a large potential market that will certainly sustain the company as it expands to 50-100 seats by 2026 and 100-200 seats by 2030.

Main Competitors

Suppliers of conventional powertrains for aircraft, and a small group of companies working on green (also biofuel-based) solutions.

Contact

Current Investors

Horizons Ventures

Shell Ventures

Breakthrough Energy Ventures

Climate Pledge Fund

Ecosystem Integrity Fund

End-user Device Manufacturing (Key)

End-user Device Manufacturing (Key)

End-user devices will be the consumers of green hydrogen below the utility level. Whether in homes or businesses, they will determine how the energy stored in hydrogen will be most efficiently transformed into, and utilized as, heat and power in the consumer device setting.

Initially, many manufacturers in this segment will use the fuel cells they design and build themselves. As fuel cells become more generic and widely available at high efficiency and low cost, it is likely that the number of manufacturers in this segment that manufacture appliances for household and small business house will grow rapidly to service the decarbonization of residential and business buildings.

Some manufacturers, such as Viessmann, are preparing for both co-generation and pure heating applications by selling co-generation units driven by fuel cells on the one hand, while at the same time developing a gas condensing boiler system for 100 percent hydrogen use in a stand-alone hot water system.

Manufacturing of small integrated co-generation units for household use is regionally skewed based on acceptance, government support for such systems, and consumer uptake. Japan started early with trials and acceptance education and today sports a lively manufacturing market. One important player here is Aisin Corporation. Europe generally and Germany in particular has seen strong support for the introduction of co-generation units, and manufacturers such as Viessmann and SenerTec are particularly active and well-regarded.

Green Hydrogen Heat and Power Generation (Key)

Large-scale production of heat and power from green hydrogen will be done by utilities, large industry, local governments, and institutions. The plants, engineering, and technologies that make this possible will play a key role in the acceptance and growth of green hydrogen during the decarbonization process.

At a very large scale, the generation of heat and power may not make use of fuel cells, due largely to scaling issues. Instead, this will feature the combustion of hydrogen in gas turbine motors, patterned on models formerly used for natural gas. These scale well, can deliver both heat and power (co-generation), are highly efficient, and can be integrated into container-sized units for easy shipment and placement where needed. These units can achieve combined efficiencies upwards of 80 percent.

2G Energy AG produces such units for use by smaller utilities to provide heat and power to smaller communities, for example. The units are generally highly reliable and can be used to balance supply when renewable energy sources perform variably.

Engie Solutions, Siemens Gas and Power, Centrax, Arttic, the German Aerospace Center (DLR), and four European universities are implementing a project funded by the European Commission under the Horizon 2020 Framework Program for Research and Innovation. The HYFLEXPOWER pilot will be the first fully integrated power-to-X-to-power demonstrator with an advanced hydrogen turbine.

Power-to-X-to-power indicates the ability to convert electricity to hydrogen and back to electricity at an industrial scale. The installed demonstrator will be used to store excess renewable electricity in the form of green hydrogen. During periods of high demand, this stored green hydrogen will then be used to generate electrical energy to be fed into the grid.

Infrastructure Construction (Peripheral)

The construction of required infrastructure for the distribution and storage of green hydrogen will require strong growth in specialized construction areas, including new (also lower-capacity) hydrogen pipelines, storage facilities, transshipment facilities, and so on.

Those construction companies set up for these types of construction, such as Enbridge in the US; bp, Evonik, Nowega, OGE, RWE, Salzgitter Flachstahl, and Thyssengas in Europe; and Kawasaki in Japan, will benefit from increased infrastructure demands.

Construction aimed at converting legacy fuel infrastructure for use with hydrogen (see section 4.3.3 below) will help reduce the costs incurred by new construction. Companies like E.ON, which has started a project to repurpose a natural gas pipeline for pure hydrogen transmission, will be well-positioned to move into this new market space.

Hydrogen Transport Media (Key)

Hydrogen Transport Media (Key)

Hydrogen presents a range of challenges when it comes to transport. Current technologies – transporting hydrogen as a gas or as a cooled, compressed liquid – tend to be bulky, expensive, and inefficient.

The search is therefore on for better ways to transport hydrogen, with “better” in this case implying denser, less volatile, at more appropriate temperatures, and at a reasonable cost. One option here is to use ammonia (NH3) as a chemical carrier, but this requires the conversion and reconversion of the carrier gas at the start and end of the transport process, and the carrier itself has density and flammability issues. That said, ammonia is easier to handle than hydrogen itself.

Research and development efforts are underway regarding new technologies for transporting hydrogen reversibly in other dense and stable media. Currently, Liquid Organic Hydrogen Carrier (LOHC) technologies seem especially promising.

One company that has developed and successfully implemented a full cycle on-load/offload and transport technology is Hydrogenious LOHC Technologies GmbH (Germany). They have just seen the kick-off for construction and operation of the world's largest project plant for storing green hydrogen in LOHC in Dormagen, Germany. The company is also attracting a high degree of interest from the automotive industry, and has just received additional investment from global auto maker Hyundai Motor Company. Another player in this area is Framatome GmbH.

Companies involved in the development and sale of the components required to handle LOHCs will also be able to benefit from growth in this new market. One example is Wagner Mess- und Regeltechnik GmbH (Germany), who manufacture and sell LOHC pumps. Covalion, a maker of LOHC fluid, is another company that stands to gain from growth in the hydrogen transport sector.

Dimethyl ether (DME) is also being trialled as a carrier. It has a few downsides, but once these are resolved, DME could have significant potential impact, especially if inserted in technological chains of CO2 sequestration and utilization.

Hydrogen Distribution and Storage (Key)

Hydrogen Distribution and Storage (Key)

Distribution and storage are key aspects of ensuring that green hydrogen is available where and when it is needed. The challenges hydrogen brings in this area are well known, and a number of companies have developed solutions. The players with the most reliable and cost-effective solutions to said challenges are likely to profit extensively from the massive growth in the use of green hydrogen.

The segment covers quite a wide range of specific products and services, including storage vessels, transport vehicles, refrigeration technologies (Kawasaki, for example, has developed a cryogenic technology for mass transportation of hydrogen by sea), and pipeline solutions (SoluForce has developed a spoolable industrial Reinforced Thermoplastic Piping or RTP system specifically certified for hydrogen applications).

Other companies active in the construction and realization of filling stations and related equipment include Linde Engineering (stationary), Wystrach GmbH (mobile), Air Liquide, Nel Hydrogen, and H2 MOBILITY.

Focusing on on-site generation: WS Reformer GmbH

Vehicle-based storage solutions: Hexagon

General storage and distribution solutions: HYON, NPROXX, Hydrogenious LOHC Technologies GmbH

Components, technologies, and services: STASSKOL (seals), NEUMAN & ESSER GROUP (compressors)

An interesting example of a startup in this segment focuses on storage: H2G Power.

H2GO Power

Clean Energy, CleanTech

London, England, United Kingdom

Products & Services

H2GO Power develops safe and low-cost hydrogen production and storage technologies.

Target Market

The dense, affordable, and safe storage of large quantities of green hydrogen, for use in refueling, heat and power generation, and power-to-X-to-power applications.

Perceived Risks & Opportunities

As safe and affordable hydrogen storage is considered the holy grail of the industry, opportunities abound for successful technology providers. The main risk is price, but as other forms of storage are also quite expensive, this is less of a risk than might otherwise be the case.

Main Competitors

Conventional hydrogen storage technology providers – tanks, refrigerated liquid storage, and so on – and those offering new innovative storage technologies, such as LOHC or methane-based storage.

Contact

Current Investors

Unknown

End-user Green Hydrogen Sales (Key)

End-user Green Hydrogen Sales (Key)

The sale of hydrogen to end users is likely to depend either on last-mile pipelines to buildings, transport by pipeline or truck to industrial consumers, or filling stations. The more interesting generic market here will likely be the development of safe and reliable filling stations for a variety of commercial vehicles.

A number of organizations are entering this field. Based on the requirements figures raised in the US, Europe, and Asia for the number of filling stations needed to satisfy rapidly growing demand, companies coming out with early, solid products in this area are likely to profit from that growth.

They include Linde Engineering (which has designed a turnkey filling station concept to support its line of hydrogen trucks), ITM Motive, McPhy, Houpu Clean Energy Co., Ltd., and Nel ASA.

However, not all hydrogen used on site needs to be shipped in. For commercial use, for example in forklifts in a warehouse, hydrogen could be generated on site. An interesting solution for this application comes from the startup Ergosup:

Ergosup

Biomass Energy, Innovation Management, Renewable Energy

Malataverne, Rhone-Alpes, France

Products & Services

Ergosup is developing an innovative process for producing high-pressure hydrogen on site for refueling hydrogen fuel vehicles.

Target Market

Entities and activities utilizing fleets of fuel cell vehicles that require localized refueling, such as warehouses.

Perceived Risks & Opportunities

The need to locally generate hydrogen to refuel commercial and industrial vehicles will grow quickly as fuel cell vehicles penetrate the market. While purchase and local storage of green hydrogen is certainly possible, it has its own risks and related issues. As such, the market for a local generation option will grow quickly, especially as it obviates the need for last-mile transport of hydrogen in areas where such infrastructure does not exist. However, cost is a potential barrier, as mass-produced green hydrogen could be cheaper. As such, if the cost of hydrogen located locally is significantly higher, that could slow acceptance and growth.

Main Competitors

Commercial, centralized mass producers of green hydrogen.

Contact

Current Investors

Demeter

Demeter Partners

GO CAPITAL

Arkea Capital Investissement

AP Ventures

Other investors in this segment include Gimv, Sofinnova Investments, Amundi Private Equity Funds, Demeter Partners, CDC Enterprises, and EASME – the EU Executive Agency for SMEs.

Vehicle Conversion and Manufacture (Peripheral)

The vehicle conversion segment is extremely important for the decarbonization of high-use commercial vehicles. Trials and active manufacturing are developing apace.

Buses are a very important door-opener in the urban context, bringing both green and clean energy to combat both pollution and climate change. A number of companies are active here, including Daimler, which manufactures the Mercedes-Benz Citaro FuelCELL-Hybrid bus. Thor Industries has an active fleet based on UTC Power fuel cells. Iveco Bus uses a drivetrain from Fiat Powertrain Technologies. TATA Motors has created India’s first hydrogen bus, the StarBus, while Van Hool (using Ballard) has commercial fleets in passenger service in Scotland. Wrightbus, owned by Bamford Bus Company, has recently had recognition of their double-decker fuel cell bus from the UK government, including a cash infusion.

Trains are an important entry point for the decarbonization of freight and passenger transport. The hydrogen fuel cell-powered Alstom Coradia iLint passenger train entered service in Germany in 2019, with the Netherlands due to follow suit. Porterbrook has developed the HydroFlex fuel cell traction concept, which has been tested in the UK on a legacy Class 319 unit, and Alstom has collaborated with Eversholt to develop their Breeze platform based on a legacy Class 321unit. Siemens, in cooperation with Ballard, has been developing its Mireo Plus H Fuel Cell Hydrogen Train for middle-distance passenger rail routes. It has an announced range of up to 1,000 km. Swiss manufacturer Stadler is developing the Flirt H2 hydrogen fuel cell train for the US market. It is aimed at long-range transportation.

Trucks create an access point for green road-based freight haulage. In Europe, H2Haul is an EU-funded project that aims to deploy 16 zero-emission fuel cell trucks at four sites. The Nikola Corporation, working closely with Bosch, has created an integrated infrastructure of hydrogen trucks and filling stations, while Hyundai has created the XCIENT Fuel Cell truck. Toyota has created the Kenworth T680, prototypes of which are being tested as container haulers at the ports of Los Angeles and Long Beach (US). Daimler Trucks and Volvo Group have an agreement to co-develop fuel cell systems for Class 8 trucks for use in their own branded products and will compete against each other. Dongfeng Special Vehicle Co., Ltd. constructed 500 hydrogen trucks for use in Shanghai, China in 2019, currently based on a powertrain by Ballard and REFIRE, and is aiming for annual production of 3,000 units.

Vehicle Sales & Maintenance (Peripheral)

Vehicle Sales & Maintenance (Peripheral)

The sale of fuel cell vehicles will largely lie outside the domain of conventional consumer vehicle sales, as most of those vehicles will be aimed at business and industry, with a high emphasis on larger fleets. Specialized sellers servicing those markets today will have the opportunity of selling a broader range of vehicles covering additional fuel sources.

Here, those moving quickly to facilitate fuel cell vehicles may lure away customers from those slow to react. At the same time, strategic alliances with suppliers of small-to-medium scale generation, storage, and fueling infrastructure could see one-stop-shopping for those interested in introducing such vehicles into their fleet, a significant competitive advantage.

End-user Device Sales (Peripheral)

In the case of household devices, sales can be handled by current purveyors of household appliances, as specifications and requirements are relatively straightforward. For larger installations, sales will require specialized engineering support that will likely initially be provided by manufacturers themselves, later growing outwards as spin-offs that should be both stable and show strong performance and growth in a burgeoning market. These would be interesting targets for those interested in stable, low-risk investments.

End-user Device Installation & Maintenance (Peripheral)

The installation of smaller co-generation units in households and business will not excessively tax the current household installers, as the devices are self-contained and typically straightforward to connect. For larger installations, more expertise will be required.

On the other hand, maintenance of the fuel cells in particular will probably need to be handled by a new generation of maintenance technicians, and will bring diversity and growth into the market.

Heat & Power Sales & Distribution (Peripheral)

The innovation in generating, selling, and distributing heat and power in cities, towns, and villages will primarily fall to utilities and energy-as-a-service (EaaS) providers. Due to a high level of conservatism in traditional utilities, those countries with liberalized energy markets and good feed-in regulations and tariffs will likely see the growth of smaller, independent, or community-owned utilities and an increased use of district heating networks to provide green heat to residences and businesses.

As co-generation is highly efficient, the use of green hydrogen makes it possible to generate, store, and apply green hydrogen to meet the needs of both smaller communities and dense urban areas.

Thus, countries that have liberalized their energy markets, that have good renewable energy resources, and whose populations are willing to (re)consider their energy provider will see significant investment potential in new, smaller non-conventional energy providers.